Columns

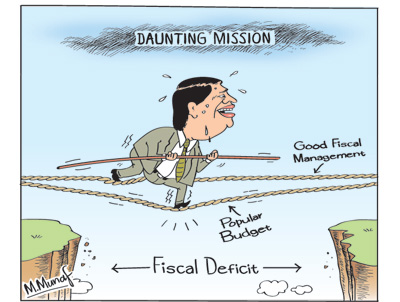

Budget continues fiscal populism and changes expenditure priorities

View(s):The four-and-a-half hour marathon budget speech by Finance Minister Ravi Karunanayake covered nearly every sector and sub sector of the economy, even the government’s policy to increase arecanut production. It was populist in its proposals, reiterated the government’s economic policies and reoriented public expenditure priorities towards education and health.

This budget once again exemplified the fiscal populism that has dominated budgets for many years. Despite the Finance Minister quoting John F. Kennedy’s celebrated exhortation, “Ask not what the country can give, but give what you can to the country”, the budget was a recitation of what the government would give people: reduced commodity prices, housing, subsidies and price guarantees among others.

This budget once again exemplified the fiscal populism that has dominated budgets for many years. Despite the Finance Minister quoting John F. Kennedy’s celebrated exhortation, “Ask not what the country can give, but give what you can to the country”, the budget was a recitation of what the government would give people: reduced commodity prices, housing, subsidies and price guarantees among others.

Fiscal deficit

Consequently expenditure increased from 19 percent of GDP to 22 percent. Revenue was expected to increase from 13 percent of GDP to 16 percent. The budgeted fiscal deficit remained high at 5.9 percent of GDP and fiscal consolidation unrealised. This budget too was seeking political popularity rather than facing up to the serious fiscal situation the country is in.

Economic policies

This first budget of the new government, together with the Prime Minister’s Economic Policy Statement provides the economic framework of the government. They indicate the direction and thrust of its economic policies that are a break from the economic policies of the last regime.

Higher reliance on private and foreign investment, lower expenditure on mega physical infrastructure, curtailing of wasteful and unproductive expenditure, increased expenditure on education and health and care of the elderly and reduction of losses of state owned enterprises are key areas of policies that have been announced.

Higher reliance on private and foreign investment, lower expenditure on mega physical infrastructure, curtailing of wasteful and unproductive expenditure, increased expenditure on education and health and care of the elderly and reduction of losses of state owned enterprises are key areas of policies that have been announced.

The economy returns to less statist policies with greater dependence on private enterprise, foreign investment, higher emphasis on exports and liberal trade policies. These policies are positive steps in the right direction. Yet there is a huge gap between the announcement of these policies in the budget and their effective implementation. Enhancing institutional capacities, selection of efficient administrators rather than friends and relations and a political will to run an effective administration are key conditions for success.

Fiscal consolidation

Fiscal consolidation has to be achieved by both a containment of expenditure and an increase in revenue. The expenditure indicated in the budget proposals increase public expenditure from 19 percent of GDP to 22 percent, while revenue increases from 13 to 16 percent. The resultant fiscal deficit is far too high in the current financial predicament.

Education expenditure

A key feature of the 2016 budget is a reorientation of expenditure with considerable emphasis and prioritisation on education and health. Education and health expenditure is increased more than two fold from Rs. 98 billion to Rs. 210 million. This noteworthy feature of a substantial increase in the allocation of education expenditures to 5.4 percent of GDP is to implement a host of educational reforms.

The budget gave detailed proposals and many programs which would utilise this expenditure for reform and improvement of primary secondary, tertiary and technical education. The government not only allocated 5.4 percent of GDP for education but intends to bring about reforms that would transform education to make it a more productive investment.

Infrastructure

Expenditure on infrastructure is expected to increase signficantly. While expenditure on the President’s office has been slashed from Rs 11.9 billion to Rs 2.3 billion, there was no reduction in defence expenditure. As in the past five years after the war, defence expenditure continues to be increased.

Revenue

The increase in direct taxes falling on the affluent, decreasing the regressive indirect taxes, reducing government expenditure on loss making enterprises, divesting burdensome state enterprises, new taxation measures to increase revenue are indeed moves towards increasing revenue. Whether these measures would be effective in raising revenue adequately remains to be seen. Tax avoidance and tax evasion remains a serious flaw in fiscal operations.

Bottom-line

While this budget has failed to address the issue of fiscal consolidation, the government expects its development strategy and policies to bring down the fiscal deficit to 3.5 per cent in 2020. Far too often past budgets too have indicated such objectives of containing the fiscal deficit but shortfalls in revenues and expenditure overruns have increased the deficit rather than reduced it. It is these continuous fiscal deficits that have led to the government’s revenue being hardly adequate to meet even its current expenditure.

In 2014 revenue met only 95 per cent of expenditure, while the year before expenditure was 105 per cent of revenue. The 2016 budget expects total revenue and grants to cover 97 percent of recurrent expenditure. The fiscal deficit is expected to be reduced only marginally to 5.9 percent of GDP in 2016 from to this year’s 6 percent. In fact the expectation of a 6 percent fiscal deficit is unlikely. It is more likely to reach 6.5 percent at the end of this year.

The 2016 Budget seeks to increase revenue from its current low of 13 percent of GDP to 16 percent of GDP. Its taxation measures are less regressive with direct taxes expected to yield a higher proportion of revenue from next year. Revenue is also expected to be increased by the sale of unproductive state assets, and sale proceeds of state enterprises. Whether these measures would achieve the desired objective of decreasing the fiscal deficit to 3.5 percent of GDP in the next four years remains to be realised. Achieving such a target is a challenging task owing to inefficient tax administration and opposition and evasion of taxes by the affluent. The impact of the budget on the investment climate and the growth momentum of the economy would be critical factors in achieving the fiscal targets.

What has not been specifically mentioned is that the implementation of these policies requires international support as the country is in dire financial straits. An IMF facility to meet the critical balance of payments problem, while long term credit from international development agencies are essential to support the country’s investment program that has to more or less depend solely on the foreign financing. Given the large foreign debt these investments must be from long term low cost international development agencies such as the ADB and Wold Bank rather than from high interest short term commercial borrowing.

Leave a Reply

Post Comment