Columns

Policies and reforms to cope with demographic changes; extension of retirement age essential

View(s):The policies and reforms to cope with the emerging socio economic issues of an ageing population and a large old age dependency are inadequate. There is an inbuilt difficulty to reform past practices and inadequate finances for providing needed institutional capacity.

Ageing Population Profile

Ageing Population Profile

The population is projected to grow continuously till around 2031 when it reaches 21.9 million and then begins to decline thereafter to 20.7 million by 2056. During this period the population would be ageing at an unprecedented momentum. The proportion of those over 60 years has doubled during the past 20 year period 1981-2001. According to Prof. Indralal de Silva’s recent population projections, the median age of the population is projected to move up from 33.6 years in 2016 to 45.9 years in 2056. Nearly one half of the country’s population is expected to be above 60 years at the middle of this century. This rapidly ageing population brings with it serious economic and social problems.

Economic and social problems

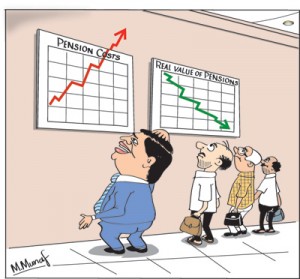

The economic and social consequences of the ageing population in the next three decades pose serious economic and social challenges. The inadequacy of retirement benefits, the financial burden of retirement benefits to the government and private institutions over a longer period, the care of the elderly and the emerging health problems associated with an ageing population are serious challenges. These emerging problems of an ageing population necessitate policies, reforms and building institutional capacities to cope with them.

Economic implications

The ageing of the population has a number of economic implications that bear on the well-being of the elderly. Less than one half of those who live beyond the working age have retirement benefits. Even among those who have retirement benefits, the retirement benefits are inadequate for the extended post-retirement period.

Although the country has several social-security systems, such as the Employees Provident Fund (EPF), the Employees Trust Fund (ETF), private pension schemes, and a public servants pension scheme and a widows and orphan pension scheme, these do not take care of the expenditure needs of the elderly at retirement adequately. Inflation and increasing costs of medical needs render these inadequate during the later stages of their life. Furthermore such retirement benefits cover only about one half of the working population, as most employment is in informal activities.

Although the country has several social-security systems, such as the Employees Provident Fund (EPF), the Employees Trust Fund (ETF), private pension schemes, and a public servants pension scheme and a widows and orphan pension scheme, these do not take care of the expenditure needs of the elderly at retirement adequately. Inflation and increasing costs of medical needs render these inadequate during the later stages of their life. Furthermore such retirement benefits cover only about one half of the working population, as most employment is in informal activities.

The public service pension scheme covers only about 1.5 million, and the provident funds and pension schemes in the private sector cover around two million. Therefore these retirement benefits cover at most about one half of the workforce.

The remaining three million or more workers in the unorganized or informal sector have to rely largely on their savings or participation in several new pension schemes for informal workers that cover only a small proportion of self-employed workers.

Extended life after retirement

The already inadequate coverage of persons under social-security programmes is aggravated by the fact that these persons would be required to have the means for an extended period of living. Life expectancy, which is currently at about 75 years, is expected to increase to about 78 years in 2045-2050. These added years of life will have to be financed from savings made during the working years.

Even where EPF, ETF and other private schemes cover employees, these are most often inadequate. These schemes have low returns on funds, and expected annual real incomes from them are both inadequate and diminishing over time. There is a need to reconsider the financing of these schemes and their investment funds, so as to generate a better return to retirees. Higher contributions during the period of employment need to be considered.

The extended period of retirement implies that any pension scheme to be sustainable would require significantly larger sums as contributions from employers and employees during the period of employment. If the average working years are 30 and the period of retirement is 15, then the contributions of 2 years of working life would have to finance 1 year of retirement benefits, assuming that the rate of inflation would be equal to the interest earnings of the funds. This implies very high contributions or low retirement benefits.

Financial viability of pension schemes

While pension benefits are inadequate, the pension schemes would have to pay out monthly pensions over a longer period of time. Owing to the longer life expectancy, the heavy burden of retirement benefits would impair the viability of pension schemes. Although the viability of the government pension scheme does not arise, as the payments are from the annual budget, when retirees live for longer periods and there are excessive intakes into the public services, the expenditure on pensions escalate each year. This has serious implications on the public finances of the country.

At present, government pensions absorb over 15 per cent of current expenditure. In the near future government pensions could absorb as much as 20 to 25 per cent of expenditure and distort public expenditure patterns with serious implications for public investment and economic growth.

Retirement age

The implications of these problems are the need to revise the employment-life span. The retirement age of 55 years for men and 50 years for women in the public service, with a possible extension of another 5 years, was designed at a time when the country’s life expectancy at birth was around 55 years.

With the current life expectancy of about 75 years, and an expected increase in life expectancy, there is little justification for retaining the retirement age of 55 years. Other countries with an ageing population and increased life spans have been revising their retirement ages. Canada, Singapore and many states in the USA have extended their mandatory retirement age by about 5 years and some countries do not have a retirement age.

Conclusion

An extension of the retirement age to 65 years would place less strain on current contributions, could increase retirement benefits and would reduce the period during which retirement benefits would be needed to support retirees. Such an extension in retirement age would not seriously affect youth employment, as the numbers entering the labour force are expected to decline in the future. The government must take steps to increase the mandatory retirement age to 65 years.

Leave a Reply

Post Comment