Columns

Trade deficit widens despite fuel price decline

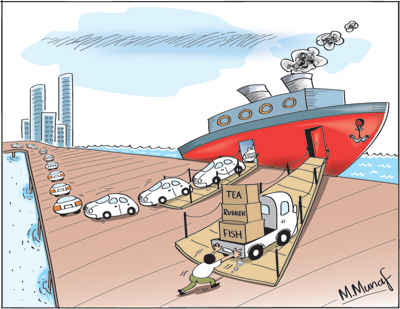

Although the recent steep decline in international fuel prices reduced oil import expenditure significantly, the trade deficit increased in the first four months of this year. This was mainly due to lower export earnings. Tea export earnings declined by as much as 13 percent to only US$ 437 million in the first four months of this year. Fish, rubber manufactures and garments exports too declined.

A decrease in fuel prices is a significant advantage to the Sri Lankan economy as about one fourth of the country’s import expenditure has been on oil imports in recent years. However, the sharp decline in oil prices has been a mixed blessing as the advantage of reduced oil prices has been offset by reduced export earnings from tea and rubber manufactures in the first four months of this year.

A decrease in fuel prices is a significant advantage to the Sri Lankan economy as about one fourth of the country’s import expenditure has been on oil imports in recent years. However, the sharp decline in oil prices has been a mixed blessing as the advantage of reduced oil prices has been offset by reduced export earnings from tea and rubber manufactures in the first four months of this year.

Decreased oil imports

There was a significant decline in oil import expenditure by 47.7 percent in the first four months of this year in spite of an increase in the quantity of oil imports. Consequently, there was a decrease in intermediate imports by 18.6 percent in the first four months of this year compared to that of the first four months of last year. This year’s oil imports were only 15 percent of total imports, whereas oil imports constituted 25 percent or more in previous years.

Decreased oil imports expenditure did not, however, result in a decline in imports. Import expenditure increased by 1.5 percent owing to a 50 percent increase in consumer imports and a 22 percent increase in investment goods imports. A substantial increase in motor car imports that nearly doubled (95.7 percent) compared to that of the first four months of last year was a significant reason for increased imports. The expenditure on motor vehicle imports of US$ 385 million in the first four months was 85 percent of tea earnings for the same period and nearly 11 percent of total export earnings.

Reduced tea exports

Reduced tea exports

Export earnings from tea declined owing to a fall in demand from oil exporting countries in the Middle East and Russia — key export destinations for our tea. The decline in international oil prices has had a severe impact on our tea exports. In the first four months of this year tea exports declined by as much as 13 percent and earned only US$ 437 million. This decrease in export earnings has been due to reduced demand for tea from oil exporting countries that are the main markets for our tea.

The decline in demand for tea from Russia and the Middle East has been significant. Tea exports to Russia decreased by 39 percent, while tea-export earnings to the Middle East dropped by 5.5 percent in the first four months. Tea export earnings have been decreasing since March 2014.

Other exports

Rubber prices too fell owing to the decline in oil prices and synthetic rubber prices. Exports of garments and fish also declined in the first four months of this year compared to the same period last year.

Compounding the problem of lower exports of tea has been the decline in exports of fish to the European Union. Fish exports declined by 37 percent in the first four months of this year from that of the same period last year to be only US$ 57.5 million compared to US$ 91.3 million in the first four months of last year. This was owing to the EU ban on Sri Lankan fish exports from January 2015.

Widening trade deficit

Despite the huge advantage of much lower fuel prices reducing fuel import expenditure sharply, the international oil price decline has had a severe impact on tea export earnings. This together with reduced exports of fish, industrial exports increasing by only a modest 2.5 percent and investment goods imports and vehicle imports increasing, have resulted in the widening of the trade deficit to US$ 2.7 billion for the first four months of this year.

Despite the decreased expenditure on fuel imports, the trade balance deteriorated by 3.9 percent. A continuation of this trend for the rest of the year could result in this year’s trade deficit exceeding US$ 8 billion, as in the past two years. The reduced import expenditure on oil did not enable a reduction in the trade gap owing to the poor performance of exports during the first four months of 2015 compared to the same period last year.

The external trade performance this year has not been favourable despite the huge advantage of lower import prices for fuel that reduced the import bill sharply. It is unfortunate that the benefit of the sharp decrease in fuel prices could not be an opportunity to decrease the trade deficit.

Remittances and tourism

Fortunately, there is a healthy increase in remittances by 2.2 percent and an increase in earnings from tourism by 12.5 percent in the first four months. Remittances amounted for US$ 2.3 billion and tourist earnings reached nearly US$ 1 billion (US$ 985 million). These two sources of foreign earnings are likely to generate a balance of payments surplus, despite a trade deficit of over US$ 8 billion.

While the economy would continue to benefit from decreased oil prices, there is a prospect of a steady increase in fuel prices in the next few months. The depressed demand for tea would also continue. Hopefully the decreased incomes of Middle Eastern countries would not reduce employment for Sri Lankan workers.

Prospects

The two bright spots on the horizon are the likely restoration of the GSP Plus concession by the US and a similar decision by the European Union, giving industrial exports a boost. The likely removal of the ban on fish exports to the EU should provide opportunities to increase fish exports substantially.

Leave a Reply

Post Comment