Columns

Weaknesses and vulnerability of external finances

View(s): Sri Lanka’s external finances are weak owing to the large foreign debt and persistent large trade deficits. The huge trade deficits are in turn due to weaknesses in the import and export structures. The character and composition of imports make it difficult to reduce imports, while the concentration of exports in a few commodities makes them susceptible to external shocks. These features render the external fortunes of the country vulnerable to vagaries of international price movements and global economic performance.

Sri Lanka’s external finances are weak owing to the large foreign debt and persistent large trade deficits. The huge trade deficits are in turn due to weaknesses in the import and export structures. The character and composition of imports make it difficult to reduce imports, while the concentration of exports in a few commodities makes them susceptible to external shocks. These features render the external fortunes of the country vulnerable to vagaries of international price movements and global economic performance.

The reductions of the foreign debt, containing import demand and increasing exports are vital to improving the country’ external finances. The weakest facet of the country’s external finances is the large foreign indebtedness and high debt servicing costs. Persistent large trade deficits, due to imports being in excess of export earnings, are the other fundamental weakness in external finances. The nature of the import structure and composition of exports disclose weaknesses in the country’s trade pattern that causes trade deficits. The improvement in the trade balance is difficult but has to be achieved to strengthen the nation’s external finances.

Foreign indebtedness

Foreign indebtedness

The most serious weakness in the external finances is the large foreign indebtedness and high debt servicing costs. The foreign debt was US$ 39.7 billion at the end of 2013. This was 59.2 per cent of that year’s GDP and its servicing costs absorbed 25 per cent of earnings from exports and services. The country is heavily indebted to international organisations, commercial lenders and to China. Further foreign borrowing could lead to a foreign debt trap.

The foreign debt is likely to be underestimated as some debts and contingent liabilities may not be included. The debt may have risen significantly to around US$ 50 billion by the end of 2014 but there are no firm figures. This large foreign indebtedness means that steps should be taken to reduce it to a more manageable magnitude to reduce the country’s foreign debt vulnerability.

Trade deficits

Large trade deficits are indicative of fundamental disequilibria in the economy. There have been large trade deficits in recent years with imports nearly double exports. In 2013 and 2014 exports were only 57 percent of imports. The large trade gap is in turn the result of weaknesses in the import and export composition. Bringing down the trade deficit is difficult owing to the nature and composition of the country’s imports.

Imports

Imports

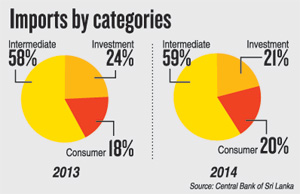

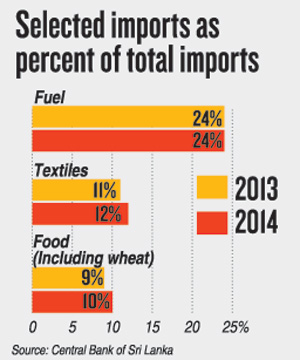

The structure of imports shows clearly the difficulties of containing imports. In 2014, intermediate imports accounted for 58.7 per cent of total imports. This consisted of about 25 per cent of oil imports. About 12 per cent consisted of textile imports that are the principal raw material for the country’s largest industrial export of garments. Other intermediate imports consisted of chemicals, base metals, plastics paper and other essential raw materials for industry. Fertilizer imports for agriculture was only 1.4 per cent of total imports in 2014.This large dependence on imports of intermediate goods essential for the economy makes it difficult to contain import expenditure.

Consumer imports were much less at about 20 per cent of total imports in 2014. These consumer imports included food imports (including wheat) that accounted for 10.5 per cent of total imports. Most food imports, such as wheat, sugar, milk and a variety of basic foods, are essential and any significant reduction is difficult. Vehicle imports have been significant in recent years. In 2014 vehicle imports were 4.6 percent of total imports.

Imports essential

This analysis shows that the import structure is one in which essential imports constitute a significant proportion of imports. This is especially so with respect to petroleum imports that alone have constituted about one fourth of import expenditure. Raw materials such as textiles that are essential too constitute a high proportion of imports. Curtailing imports is difficult owing to most imports being of an essential nature and as the import content of domestic consumption is high.

One of the main import weaknesses is that fuel imports have constituted about 25 per cent of total imports in recent years. In 2013 and 2014 due to a reduction in international oil prices, fuel imports were about 24 per cent of total imports. When fuel prices rise, the increase in import expenditure is significant. There is very little possibility of reducing the volume of oil imports. Only a marginal decrease in imports has been achieved in recent years by increasing domestic prices of petroleum products.

Investment goods imports

In recent years, investment goods imports have also been significant because of the large expenditure on infrastructure projects. In 2014 most investment expenditure was on machines and equipment, building materials and transport equipment. It is likely that this expenditure could be curtailed to some extent owing to changes in economic policy.

This import structure means that whenever there is an increase in aggregate expenditure, the high import content of such expenditure leads to increased imports. This vulnerability is one of the serious weaknesses in the country’s trade structure.

Reducing vulnerability

A precondition of strengthening external finances is the recognition of the seriousness of the problem. There has been complacency about this serious problem that has led to further indiscriminate borrowing. Economic policies to contain foreign debt, ensure imports are restrained and exports are expanded are crucial.

The reduction in the foreign debt can only be achieved by limiting foreign borrowing to finance productive investments and by borrowing long term from multilateral agencies and friendly countries at reasonable rates of interest. It is essential that the trade deficit is brought down to achieve a balance of payments surplus.

The analysis of the import structure above disclosed that there is little leeway in restricting imports except by fiscal and monetary policies that constrain aggregate demand. Prudent public expenditure too could reduce imports, especially of investment goods. The best option is that of increasing the country’s exports. The structural weaknesses in the export composition require to be changed in order to expand exports.

Leave a Reply

Post Comment