Columns

Do recurring trade deficits matter when there are balance of payments surpluses?

View(s): Trade deficits have been a persistent feature of Sri Lanka’s external trade. Fifty eight of the sixty four years since 1950 have had trade deficits. Despite these recurring trade deficits, there have been balance of payments surpluses in some years.

Trade deficits have been a persistent feature of Sri Lanka’s external trade. Fifty eight of the sixty four years since 1950 have had trade deficits. Despite these recurring trade deficits, there have been balance of payments surpluses in some years.

This has been so in the last five years (2010-14) when there were balance of payments surpluses in four of them in spite of large trade deficits. This was because workers’ remittances, earnings from tourism and other service receipts offset the trade deficits.

This has led to some arguing that it is the balance of payments outcome that is significant and not the trade balance. They contend that it is misleading to focus on the merchandise account as these other receipts are as important to the balance of payments. This point of view is of significance for the management of the country’s external finances.

Trade surpluses rare

There have been trade surpluses in only six years since 1950. Five of these were before 1965: in 1951,1954,1955,1956 and 1965. The last time there was a small trade surplus was as far back as 1977 under stringent import and exchange-controls. Although there has not been a trade surplus in the last 35 years since then, there have been overall balance of payments surpluses in several years.

Although trade deficits were large in the last five years (2010-14), there were balance of payments surpluses in four of these five years owing to increasing large workers’ remittances, earnings from tourism and other service receipts. Does the trade deficit matter when, despite trade deficits, there are balance of payments surpluses?

Trade deficit unimportant?

Some argue that the focus on the trade deficit is misplaced. They point out that it is the balance of payments of a country that matters as it portrays the country’s complete annual performance of external finances, while the trade balance is only a component of the balance of payments. They contend that the trade balance was significant when merchandise trade was the predominant component of the balance of payments.

In the modern context, services have grown in importance to the extent that a country’s balance of payments and external finances are significantly dependent on services income. Therefore, it is asserted that external finances are healthy when the balance of payments is in surplus regardless of trade deficits. Looking at the trade balance rather than the overall balance of payments has been characterised as an outmoded way of thinking suited to an era when merchandise trade was predominant.

This perspective is theoretically sound as what matters is a country’s overall state of external finances rather than the trade balance that is a component of the country’s external account.

Sri Lanka’s situation

Although this perception is theoretically sound, it is not applicable in the context of Sri Lanka’s external finances, as there is a very large foreign debt and debt servicing burden that is leading to a foreign debt trap. The means by which the country could come out of this impasse is by generating significant balance of payments surpluses that would enable repayment of debt and reduction of the foreign debt progressively. The reduction of the trade deficit is vital towards achieving this.

Foreign debt

Foreign debt

The country is heavily indebted to international organisations, commercial lenders and to some countries, most notably China. According to the Central Bank Annual Report of 2013, the foreign debt was US$ 39.7 billion at the end of 2013. This was 59.2 percent of that year’s GDP and its servicing costs absorbed 25 percent of export earnings and earnings from services.

The debt may have risen significantly by the end of 2014, but there are no firm figures. There could also be contingent liabilities that are not included. The foreign debt is likely to be around US$ 50 billion, which is about 70 per cent of the country’s GDP. This large foreign indebtedness means that steps should be taken to reduce it to a more manageable magnitude.

Deficits fundamental weaknesses

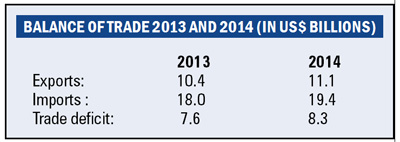

Furthermore, large trade deficits are indicative of a fundamental disequilibrium in the economy that must be corrected. Exports being only 57 per cent of imports in 2013 and 2014 are a clear sign of fundamental weaknesses in the economy. The overall balance of payments surplus is not a good reason for complacency about the trade imbalance. Disregarding the correction of this trade imbalance that is symptomatic of structural weaknesses in the economy is a serious flaw in economic management.

Strategy

Strategy

In this context of high indebtedness, it is vital to have a significant balance of payments surplus to repay debt. It is by reducing the trade deficit that such a balance of payments surplus could be achieved. Therefore, it is important to reduce the trade deficit from its current high US$ 8 billion level to around US$ 6 billion. This could increase the balance of payments surplus to around US$ 3-5 billion depending on the increases in remittances and services incomes. Much of this could be used to repay debt.

The current level of the balance of payments surplus necessitates foreign borrowing. A manageable trade deficit has to be achieved by both an increase in exports and a constraint in imports. Monetary and fiscal policies have to be geared to ensuring that aggregate demand is kept in check to restrain imports. Public expenditure has to be constrained so as to not expand imports. Tariffs and import policies must ensure a manageable amount of imports. The economic policy framework must ensure a climate conducive to increasing both merchandise exports and export or of services to improve the trade balance and balance of payments.

Summing up

While acknowledging that it is a country’s balance of payments that matters rather than the trade balance, in the context of Sri Lanka’s large foreign debt and high foreign debt servicing costs, it is important to contain the trade deficit by restraints in imports and a vigorous thrust in exports. A lower trade deficit would enable a significant balance of payments surplus that could be used to reduce the country’s foreign debt.

Leave a Reply

Post Comment