Columns

Economics of infrastructure investment: Benefits, costs and debt.

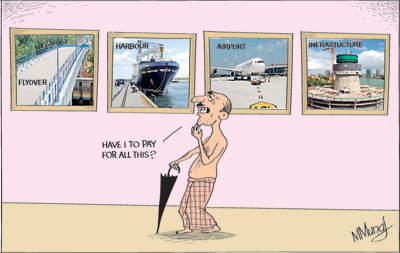

View(s): The development of physical infrastructure has been conspicuous, especially after the end of the war five years ago. One of the striking achievements of the Government has been the improvement in the country’s infrastructure that had been neglected over the years. While recognising these achievements and their contribution to the economy and quality of life, there are serious questions on their high costs and low benefits, prioritisation and sequencing of investment and the consequences of the large foreign indebtedness owing to their financing with foreign loans.

The development of physical infrastructure has been conspicuous, especially after the end of the war five years ago. One of the striking achievements of the Government has been the improvement in the country’s infrastructure that had been neglected over the years. While recognising these achievements and their contribution to the economy and quality of life, there are serious questions on their high costs and low benefits, prioritisation and sequencing of investment and the consequences of the large foreign indebtedness owing to their financing with foreign loans.

The priorities of some infrastructure investments that have limited impacts on the economy are questionable. They are economic encumbrances. Furthermore, investments in social infrastructure have been inadequate compared with the investments in physical infrastructure. Underdeveloped social infrastructure could prove to be a serious constraint in reaching higher levels of economic growth in the future.

Significant development

There has been significant rebuilding and reconstruction in the war-affected areas. The infrastructure in these areas has not only been restored and rebuilt, they have been much improved. The development and improvement of roads, highways and bridges in the North and East have been impressive. The railway to the North has been re-laid and faster and comfortable trains now link the capital to Jaffna in a few hours.

The development of infrastructure in the rest of the country too is a significant development. There has been an urban renewal in many cities and towns and rural roads and bridges have been constructed. There have also been fisheries harbours and new road linkages. The expressways to the airport and to Matara have reduced travel time significantly. Telecommunications throughout the country are as good as in developed countries.

The development of infrastructure in the rest of the country too is a significant development. There has been an urban renewal in many cities and towns and rural roads and bridges have been constructed. There have also been fisheries harbours and new road linkages. The expressways to the airport and to Matara have reduced travel time significantly. Telecommunications throughout the country are as good as in developed countries.

The country’s infrastructure that was a constraint to development in the past has been vastly improved. However, the benefits of some of the large infrastructure projects cannot be foreseen for a long time. Their costs are considered excessive and a burden on the economy, especially as the country has incurred a massive foreign debt burden.

Economic issues

Considering the large investments in infrastructure, the long periods of gestation for their benefits to mature and dependence on huge amounts of foreign borrowing, the investment in each of these projects should have been evaluated to determine the benefits and costs of the investment. Priority should have been given to projects that increase the output of tradable goods and services. What this means is that foreign-funded investment in infrastructure should generate goods and services that either save import expenditure or increase export earnings to ease repayment of debt. The investment projects should have been evaluated so that priority is given to those that generate a flow of income. Their sequencing could have ensured a lesser burden and higher benefits.

Expensive projects undertaken for political and other reasons to satisfy the fancies of political leaders have proved costly in many developing countries and resulted in economic crises. It is important to avoid such a state of affairs that would interrupt economic growth.

Debt servicing

These considerations are particularly pertinent when the infrastructure investments are foreign funded. For debt servicing to be less burdensome, it is important for infrastructure investments to generate increased production of goods for export or reduce imports.

Such benefits are not easy to measure as they are indirect benefits. Yet roads that increase marketing possibilities would induce production and reduce their marketing costs provided they are in appropriate areas. Similarly, the development of fisheries harbours would enhance fish production that could reduce fish imports or increase fish exports. On the other hand, highways that do not increase commerce would not generate tradable goods and hence their costs would have to be borne through other economic activities.

Whatever mistakes have been made in the selection of projects in the past, it is important that future infrastructure investments are evaluated and their economic benefits in relation to costs and their potential capacity to generate tradable goods directly and indirectly ascertained.

Economic benefits of foreign borrowing

Foreign borrowing is a means of developing expensive infrastructure. The economic benefits of foreign borrowing for infrastructure would depend on several factors. First and foremost the terms and conditions of the loans would matter. Infrastructure projects by their very nature are huge investments and have a long gestation period. Therefore, loans for infrastructure projects should be at low interest rates, with a period of grace before repayment begins, and the repayment of capital and interest should be over a long period. Else the loans could lead to severe financial difficulties. The loans should preferably be on concessional terms so that debt servicing costs would be less burdensome. The terms and conditions of lending and the costs and returns of the investment must, therefore, be uppermost in decision-making.

Corruption

Large investment projects tend to be excessively expensive owing to corruption. Corruption increases costs and reduces quality of construction. Therefore there must be transparent methods of giving contracts and procurement of intermediate and investment goods. Without these procedures costs would be excessive and repayment burdensome. Unless best practices are adopted in the evaluation of projects and procurement of resources infrastructure projects could be unnecessarily burdensome.

Concluding reflections

The post-war period has seen heavy investment on physical infrastructure development mostly with Chinese funding and technology. There are areas like rural infrastructure, power generation, transport development, irrigation and fisheries that require more investment.

Social infrastructure, such as education and health, need greater investment. Long-term economic and social development may be constrained due to underdeveloped social infrastructure. One of the reasons for the “middle income trap’ faced by countries is the lack of skilled technical personnel. To avoid this trap social infrastructure has to be improved significantly, especially in the areas of science and technology.

Large infrastructure projects that are not likely to generate goods and services should be avoided to ensure the country’s ability to repay foreign loans. Favourable terms of foreign funding of infrastructure investment must be explored to reduce the debt burden. Priorities and sequencing of infrastructure development is the essence of good infrastructure investment.