Columns

Puzzles and paradoxes of the Sri Lankan economy

View(s): Many aspects of the Sri Lankan economy are confusing even to economists. Unravelling these puzzles and paradoxes of economic statistics is more interesting than enlightening. Are there new paradigms to explain the inconsistencies and contradictions between the real world of everyday living and economic statistics?

Many aspects of the Sri Lankan economy are confusing even to economists. Unravelling these puzzles and paradoxes of economic statistics is more interesting than enlightening. Are there new paradigms to explain the inconsistencies and contradictions between the real world of everyday living and economic statistics?

Inflation

In no other area of the economy is it more difficult to understand the divergence than between the figures of the cost of living index and the ever-increasing cost of living of the man on the street. The prices of basic items of food such as rice, dhal, sugar, milk powder and vegetables have been rising. Yet we are constantly told that the rate of inflation is decreasing.

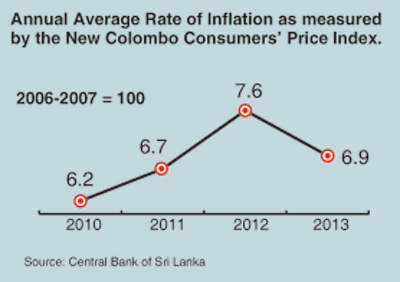

The rate of inflation, as measured by the New Colombo Consumers’ Price Index (NCCPI) with the base year of 2006-7, has been of single digit in each of the past five years and the annual average rate of inflation in these years was only 6 per cent. It was only 6.9 per cent in 2013 and 4.9 per cent in the first half of the year. It is currently as low as 3.5 per cent.

Despite this moderate increase in prices, there is a public outcry that prices are rising fast and that the cost of living is unbearable. This paradox can be explained to some extent as being due to a misunderstanding of the cost of living index. This index shows that prices are increasing but the rate of increase is low or slowing down. Prices have been increasing each year and month by month though the rate of such increase is estimated as being low.

Despite this moderate increase in prices, there is a public outcry that prices are rising fast and that the cost of living is unbearable. This paradox can be explained to some extent as being due to a misunderstanding of the cost of living index. This index shows that prices are increasing but the rate of increase is low or slowing down. Prices have been increasing each year and month by month though the rate of such increase is estimated as being low.

The increases in the index when taken for a longer period such as a year or two shows prices have increased significantly though the rate of such increase has been low or decreasing. Understanding this distinction is not easy. It is confusing to the common man. Economists make the distinction between rates of price change and the level of prices.

The NCCPI introduced in December 2007 is expected to reflect inflation levels more accurately than the previous one owing to its wider coverage of items consumed by broader income categories. Nevertheless the general public is not convinced that prices are increasing slowly as their everyday experience is one of rapid increases in prices of essential items. People remain convinced that prices are rising rapidly and that the cost of living is too burdensome.

The Business Times poll last Sunday disclosed a large proportion of respondents to the survey being sceptical about the index and being convinced that prices are rising rapidly despite the low rate of inflation shown in the official index.

Economists

Economists

Some economists too are not convinced of the veracity of the figures in the index. They contend that the weights used in the construction of the index do not reflect a correct basket of commodities consumed and perhaps they are not collected from representative markets. They have pointed out that there are deficiencies in the manner in which the prices are collected, that administered prices keep the index artificially low and that there are interventions to deliberately keep the index low. There is a lack of transparency in the computation of the index as the prices used in the index are not disclosed.

Dr. M. Sarvananthan, Principal Researcher at the Point Pedro Research Institute, in a recent analysis of the NCCPI pointed out that administered pricing deliberately kept the index low and that it did not in fact reflect the true behaviour of prices. Furthermore, he pointed out that by using a base year (2006-7) when prices were very high there is a downward bias in prices in the index. The Department of Census and Statistics that collects the price information and compiles the index has on several occasions defended both the structure of the index, the collection of prices and the calculation of the index.

Interest rates and borrowing

Another puzzle is the confusing picture of the lowering interest rates not stimulating investment. There are several reasons for the slow investment pick up despite the deliberate policy of keeping interest rates low to stimulate investment.

First of all, it is a wrong notion that interest rates alone determine investment. The array of conditions that determine investment is called the investment climate. When investment is slow to pick up despite declining interest rates, it is an indication that the investment climate is not favourable. As Milton Friedman remarked “Monetary Policy is like a string that can pull but it cannot push”. The high actual inflation despite the low increase in the price index could have had a constraining effect on private sector credit demand. Besides the rate of interest, many enterprises find it difficult to access the credit market owing to rigidities in the conditions of lending.

At the same time, the Government is using commercial banks as captive sources of deficit financing and providing credit to loss-making public enterprises. Now that the Government has control of several commercial banks besides the two wholly owned state banks, these banks too are lending to loss making state enterprises. Consequently, credit to the private sector is constrained to meet the demand of the Government and state-owned enterprises.

The Government is keeping interest rates low to keep accumulated public debt servicing costs at artificially low levels. The current economic conditions do not necessarily warrant such low interest rates.

Hard Times

The common man’s experience of high prices that he faces day-in-day out is quite in contrast to the figures of inflation. This is especially so with respect to prices of essential items of daily consumption. There is widespread scepticism that the rate of inflation is not as low as measured by the NCCPI.

One of the arguments for keeping down interest rates is the low rate of inflation and the other is that low interest rates would stimulate investment. However bank credit has not expanded as expected with low interest rates. Meanwhile, those who depend on savings interest rates have had a severe drop in their real incomes with prices of essentials increasing and incomes declining.