Columns

Economic growth destabilising long-run growth momentum

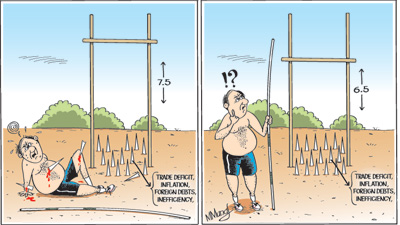

View(s):Last Sunday’s column pointed out that sustaining the growth momentum of around 7.5 per cent was difficult as the economic strategy was detrimental to longer-term economic growth. Much of the growth achieved since 2009 was due to post-war resuscitation of the economy, reconstruction and infrastructure development rather than based on increasing productivity. Therefore it does not have a self-sustaining momentum.

Furthermore, the foreign debt-driven growth, the pattern of investment, the high debt-servicing costs and deficient fiscal management are destabilising and detrimental to long-run economic growth. Therefore, these deficiencies should be corrected and reforms that enhance productivity must be initiated to sustain the growth momentum.

Furthermore, the foreign debt-driven growth, the pattern of investment, the high debt-servicing costs and deficient fiscal management are destabilising and detrimental to long-run economic growth. Therefore, these deficiencies should be corrected and reforms that enhance productivity must be initiated to sustain the growth momentum.

Different priorities in investment, reduction of huge losses in government enterprises, prudent public expenditure by cutting wasteful expenses and economic, educational and administrative reforms are necessary for long-term economic development. Economic reforms must be the first priority, for they help to achieve sustained rates of growth with a given level of savings. Without the increase in productivity, growth would depend on increasing savings alone, which cannot be sustained.

Similar conclusion

A recent IMF Working Paper entitled “Estimating Sri Lanka’s Potential Output” suggests that there may be a need to reduce the rate of current growth to achieve a higher potential growth, as the current economic growth is destabilising and would decelerate growth in the future.

The methodology

The methodology by which the IMF came to this conclusion was based on an econometric estimation of potential GDP incorporating information contained in observable data series including inflation, actual output and unemployment and capacity utilisation. It was an exploration of four different methods, all of them leading to a common conclusion within a narrow range that a gap emerged between potential and actual GDP that would entail macroeconomic imbalances.

The methodology by which the IMF came to this conclusion was based on an econometric estimation of potential GDP incorporating information contained in observable data series including inflation, actual output and unemployment and capacity utilisation. It was an exploration of four different methods, all of them leading to a common conclusion within a narrow range that a gap emerged between potential and actual GDP that would entail macroeconomic imbalances.

The IMF paper presents and compares estimates of Sri Lanka’s potential output and output gap from a number of filtering and model-based techniques. The simplest measures presented in the paper employ statistical multivariate filters. The model-based approaches have the advantages of incorporating relevant information about the economy from observable data, and allow for a richer interpretation of the resulting estimates.

Implications

The implications of this study are that for sustained growth, short-term growth has to be restrained to keep the economy on an even keel because faster growth than its capacity is destabilising. When the economy goes out of balance with respect to output, inflation, capacity utilisation and employment, the growth momentum cannot be sustained.

The IMF Working Paper and our own analysis based on basic economic principles and empirical data have led to similar conclusions that underscore the basic weaknesses of the economic strategy and performance. The IMF methodology is econometric modelling rather than the basic economic variables we discussed. The conclusions of the paper that current economic growth is not sustainable, even though tentative, require to be taken seriously.

The conclusions of the IMF study is that an economy that is operating above potential would often encounter capacity constraints that could lead to the buildup of inflation and, under certain circumstances, external balance of payments pressures. Somehow the price indices do not indicate inflation in Sri Lanka in the post-war years, but the external imbalance is evident, though mitigated by capital inflows, especially remittances, that offset 90 per cent of the trade deficit last year.

The IMF study points out that an economy with actual output below potential would often exhibit spare capacity, leading to a possible decline in those pressures. “Potential output and output gap estimates,” it points out, “are frequently used to calibrate macroeconomic policies, for example in determining the appropriate setting for monetary conditions, or in estimating structural fiscal balances and the growth impulse from the government budget.” Further it cautions: “Because potential output is not directly observable, however, estimating it is subject to a degree of uncertainty.”

However, the IMF paper poses the all-important question that we too raised. “Did the growth spurt reflect faster potential output growth and thus a permanent upward shift in the country’s growth plane, or was it a transitory increase that may have pushed the economy up against capacity constraints?”

Longer term

“The answers to such questions,” the IMF paper points out, “are important from a longer-term perspective of Sri Lanka’s possible progression through the ranks of middle income status, and from a near-term perspective they would help to indicate whether using macroeconomic policy levers to stimulate a return to high growth could come at the cost of fostering macroeconomic imbalances.”

The IMF study points to Sri Lanka’s potential output growth to be around 6.75 per cent per year, lower than the 7.3 percent achieved in 2013. Although this study does not go into the specifics of the growth strategy that has created this situation, these results are the outcome of the growth achieved by massive investments on infrastructure projects whose gestation periods are long or unproductive, the large foreign borrowing that has financed the investments but do not generate tradable goods and services, the fiscal imbalance brought about by massive government expenditure.

Unless these imbalances are corrected and a more sustainable growth strategy is adopted, the economy could face severe strains that would arrest economic growth. In whatever way one looks at, the high-growth scenario that has been achieved has within it the seeds of deceleration. There is a need for more efficient investment policies to sustain high growth.

Concluding reflection

The IMF study using a sophisticated econometric model to compare GDP growth of recent years with estimates of potential output, has come to the conclusion that there may be a need to reduce the rate of current growth to achieve a higher potential growth. The rationale for this is that the current economic growth is destabilising and would decelerate growth in the future.

The implication of both the IMF econometric study and our discussion using basic economic principles and empirical data is that there is a need to review current economic strategies and policies and effect reforms to increase the efficiency of the economy.