Columns

Achieving balance of payments surpluses despite trade deficits

View(s): Trade deficits have been a characteristic feature of Sri Lanka’s export-import economy. However, despite persistent trade deficits, it has been possible to achieve much smaller balance of payments deficits, and in some years, to even realise balance of payments surpluses. Workers’ remittances have been mostly responsible for offsetting the large trade deficits.

Trade deficits have been a characteristic feature of Sri Lanka’s export-import economy. However, despite persistent trade deficits, it has been possible to achieve much smaller balance of payments deficits, and in some years, to even realise balance of payments surpluses. Workers’ remittances have been mostly responsible for offsetting the large trade deficits.

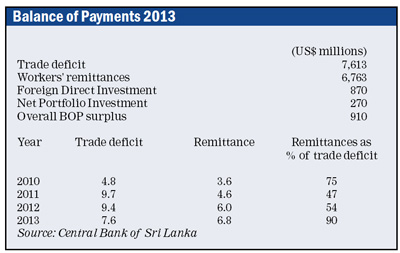

In 2013, in spite of a trade deficit of US$ 7.6 billion, the balance of payments recorded an overall surplus of nearly US$ 1 billion. The prospect of the trade deficit declining to about US$ 6 billion in 2014 provides the possibility of achieving a significant overall balance of payments surplus this year.

Last trade surplus

The last time there was a small trade surplus was as far back as 1977 under stringent import-and-exchange-control policies. Although there has not been a trade surplus in the last 35 years since then, there have been overall balance of payments surpluses in a few years. Moreover the overall balance of payments deficits have been much lower than the trade deficits. Throughout the post independent period there has been a trade surplus in only six years, five of which were before 1956.

Recent experience

Recent experience

Although trade deficits have been massive in recent years, there have been balance of payments surpluses in some years. In 2011, the trade deficit was a massive US$ 9.7 billion, yet the deficit in the overall balance of payments was only US$ 1.1 billion. In 2012, despite the trade deficit of 9.4 billion, the country achieved a small overall balance of payments surplus of US$ 151 million. With the trade deficit declining to US$ 7.6 billion in 2013, an overall balance of payments surplus of US$ 991 million was achieved.

Remittances

International transfers, better known as workers’ remittances, have been the main source of funds that have enabled an improvement in the balance of payments. These transfers of money by Sri Lankan nationals working abroad have offset between 55 to 70 percent of the trade deficit in recent years and as much as 90 per cent of the trade deficit last year. Although most of these funds are from workers in the Middle East, Sri Lankan nationals in many countries, including North America, Australia, Europe and East Asian counties have remitted significant amounts of funds.

Remittances have continued to increase over the years and especially after 2009. In 2012 remittances amounted to US$ 6 billion and offset 64 per cent of the trade deficit of 9.4 billion. In 2013 remittances grew by a further 13 per cent from that of the previous year to US$ 6.8 billion to offset as much as 90 percent of the trade deficit of US$ 7.6 billion. These remittances were mainly responsible for the overall balance of payments surplus of nearly US$ 1 billion in 2014.

Besides its contribution to reduce the trade deficit, remittances are a huge income support to families in Sri Lanka. Remittances were as much as 6 to 7 per cent of GDP from 2001 to 2011 and rose to 9 per cent of GDP in 2012. Remittances are now more important to the Sri Lankan economy than the country’s two main exports of tea or garments.

Service receipts

The second important means of offsetting the trade deficit has been earnings from services that have also been increasing after 2010. In 2012 tourist earnings estimated at US$ 1.4 billion offset 18 per cent of the trade deficit.Other service receipts that have also been increasing have contributed to offset the trade deficit and achieve an overall balance of payments surplus. These include port handling and information technology services that have been increasing and are expected to reach one billion dollars soon. These service receipts contributed about US$ 850 million in 2012.

Remittances, tourist earnings and other services have more than offset the trade deficit and the balance of payments has achieved a surplus in 2013. If the expectations of a lower trade deficit of around US$6 billion are achieved this year, the overall balance of payments surplus could be expected to be a significant surplus. This would enable a reduction in foreign debt and an improvement in the foreign reserves.

Capital inflows

Foreign inflows of funds as foreign direct investments and net inflows into the stock market too contributed to the balance of payments. Foreign direct investments in the first 9 months of 2013 were US$ 870 million while net inflows into the stock market were US$ 270 million.

Summing up

Summing up

Despite persistent large trade deficits, the overall balance of payments has either recorded lower deficits or even registered surpluses as in 2012 and 2013. There is a possibility that if a trade deficit of around US$ 6 billion is achieved this year that the overall balance of payments would be a significant surplus of about US$ 2 billion. Remittances from Sri Lankan workers abroad have been mainly responsible for this favourable outturn. Tourist earnings, earnings from other services and capital inflows have also contributed towards the balance of payments.

Despite the balance of payments surplus, the large trade deficits must be recognised as a fundamental disequilibrium in the economy that must be corrected. Imports of nearly twice export earnings are a clear sign of fundamental weaknesses in the Sri Lankan economy. The overall balance of payments surplus is not a good reason for disregarding the correction of this fundamental trade imbalance that is symptomatic of structural weaknesses in the economy.