Columns

Twist towards state control in economic policies

View(s):The election of 2004 brought about a twist in economic policies. The theoretical underpinnings and de facto policy changes of the new government under the leadership of President Mahinda Rajapaksa modified the earlier economic development strategy.

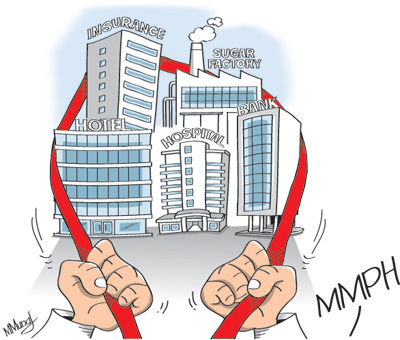

The new policies were significantly different from that of the earlier regime of the same party. Larger state intervention in the economy, enlargement of state ownership and control of economic enterprises and a tilt towards import substitution were significant policy changes. State interventions included nationalisation of previously privatised enterprises, takeover of many “loss-making” businesses and ownership and control of banks.

The new policies were significantly different from that of the earlier regime of the same party. Larger state intervention in the economy, enlargement of state ownership and control of economic enterprises and a tilt towards import substitution were significant policy changes. State interventions included nationalisation of previously privatised enterprises, takeover of many “loss-making” businesses and ownership and control of banks.

Home grown policies

The changes in economic policies were interpreted as a rejection of ‘neo-liberal economic policies’ and adoption of ‘home-grown’ policies. The Mahinda Chintanaya policy statement gave greater emphasis to domestic agriculture and rural infrastructure development.

State control of important areas of economic activity was achieved by three measures: Takeover of previously privatised economic entities; government control of banks and business enterprises by state agencies buying into their ownership and taking control of governing boards; and by enacting legislation to take over underutilised and underperforming enterprises. New government owned enterprises such as a second national airline were also established.

No privatisation

An important departure in policies was the rejection of privatisation. Previously privatised enterprises such as SriLankan Airlines, Insurance Corporation and Shell Gas were re-nationalised and Mihin Lanka, a new state-owned airline, was inaugurated. The government also gained control over several commercial banks and the Apollo Hospital (Lanka Hospitals) and took over 29 private companies that were deemed loss making concerns.

The Government gained a controlling interest in several banks with government agencies buying into share holdings. These gave the Government greater control of the economy. The 2014 Budget speech reiterated the Government’s policies of not privatising state enterprises; import substitution in agriculture and supporting import-competing industry and its commitment to infrastructure development, rural development and strengthening education in information technology.

Import substitution

Import substitution

Trade policies veered towards import substitution. Tariffs on many imported items were increased. Highly protective tariffs were imposed on basic food items such as wheat, sugar, milk, onions, potatoes and dhal to encourage domestic production of these food crops or their substitutes. In pursuance of the Government’s policy of enhancing self-sufficiency in food and uplifting the livelihoods of rural conditions, the Government embarked on a number of rural development projects that included the Hadabima, Api Wavamu Rata Nagamu and Divi Neguma projects. The Hadabima, cultivation of vegetables engaged armed forces released from fighting, while the Api Wavamu Rata Nagamu aimed at making households produce vegetables.

Improvement of infrastructure

The improvement of physical infrastructure was an important economic strategy. The Government’s extensive infrastructure development programme gained momentum after the end of the war in 2009. Roads, bridges, housing construction, power generation, ports and a second international airport were built and rural roads improved. Infrastructure was developed in the North and East.

Some large infrastructure projects do not appear to bring any tangible benefits, are costly to maintain and a continuing burden on public finances. Much of the high cost investment may not increase production of tradable goods adequately to justify their high costs and foreign debt burden.

Economic weaknesses

Despite an annual average economic growth of 7.5 per cent since 2010, large fiscal deficits, huge public debt, increasing foreign debt and massive trade deficits are serious concerns for sustained economic growth. The large public debt at nearly 80 per cent of GDP (79.1 per cent in 2012) and foreign debt of US$ 28 billion in 2012 are serious apprehensions.

Although the fiscal deficit has been brought down in recent years to around 6 per cent of GDP, it is still too high as it adds to the large accumulated debt whose debt servicing costs absorb the entirety of government revenue. Inadequate revenues, increasing recurrent public expenditure, losses in public corporations, large investment in infrastructure and imprudent government expenditure have made it difficult to bring down the fiscal deficit.

The massive trade deficits of over US$ 9 billion in 2011-2012 are a serious problem. Although the trade deficit was reduced to US$ 7.6 billion in 2013, exports are only about one half of imports and weaken the external finances.

Prospects and prerequisites

Economic prospects depend very much on enhancing the level of investment and raising the level of efficiency of public investments, while improving the economic, social, legal and administrative infrastructure. Physical and economic infrastructure-roads, rail transport, port development and energy have been expanded, but not necessarily made more efficient and productive.

It is vital to improve the quality of general education, develop scientific and technical skills, enhance scientific research capability and improve management skills and the administrative capacity of government to achieve long term growth. These factors must contribute to increase the competitiveness of Sri Lankan economy and increase exports.

Sustaining high rates of economic growth requires higher domestic savings and foreign direct investment in manufactures and tradable goods. The public debt requires to be reduced and fiscal consolidation is vital to achieve this. Foreign indebtedness should be brought down by strengthening the balance of payments by increasing exports to avoid falling into a debt trap.

Non economic factors

The road to higher rates of economic growth is not simple. The country’s prospects for higher rates of economic growth rest on a multitude of non-economic factors such as reforming the country’s education, improving the quality of education, expanding scientific and technological education and developing a system of values conducive to economic growth, improving work ethics, making all branches of government administration more efficient and less corrupt, minimizing politicisation at all levels and improving the climate for investment.

Peaceful conditions since 2009 have contributed considerably towards higher economic growth by fuller utilisation of the country’s resources. However, the investment climate has to be improved by better macroeconomic fundamentals, guaranteeing property rights and ensuring law and order.

The rule of law and enforcement of law without fear or favour are imperative.