Columns

Global economy key factor for 2014 economic show

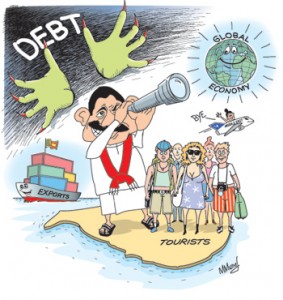

View(s):Global economic and political developments could determine to a large extent the economic performance this year. In as much as there are favourable international developments that would benefit the economy, there are possibilities of external shocks impacting adversely on the economy. Weather too could have an influence on the economy.

Global economic conditions show signs of improvement with Western economies moving towards economic recovery. The world economy is expected to grow by 3.5 per cent this year, slightly more than last year’s 2.9 per cent. More significant for Sri Lanka is the recovery of the US and Europe that are the country’s main markets for manufactured exports. The US economy is expected to grow by 1 per cent more than last year at 2.6 per cent, while Europe is expected to reverse its negative growth to achieve a 1 per cent growth. The larger economies of Europe are expected to grow at a higher rate.

Global economic conditions show signs of improvement with Western economies moving towards economic recovery. The world economy is expected to grow by 3.5 per cent this year, slightly more than last year’s 2.9 per cent. More significant for Sri Lanka is the recovery of the US and Europe that are the country’s main markets for manufactured exports. The US economy is expected to grow by 1 per cent more than last year at 2.6 per cent, while Europe is expected to reverse its negative growth to achieve a 1 per cent growth. The larger economies of Europe are expected to grow at a higher rate.

Consequently the spurt in exports of manufactured goods witnessed in the latter half of last year is likely to continue. If exports continue to increase at the pace witnessed in the last quarter of 2013, it would improve the trade balance and external finances. The uptrend in earnings from tourism too could contribute significantly to the balance of payments. However, the expected large foreign borrowing this year would increase the debt burden further.

International politics

There are signs of improved US relations with some Middle Eastern countries, especially Iran. If the improvement in US-Iranian relations takes place and leads to the removal of the trade embargo on Iran, it could enhance trading with Iran and decrease oil import expenditure and benefit tea exports.

On the other hand, developments in other Middle Eastern counties like Syria and war in South Sudan in Africa make the global situation unpredictable. The instability in these countries and cold weather conditions in the Northern hemisphere could escalate oil prices that are at present expected to decrease.

Since oil imports account for more than a quarter of the country’s import bill, oil price increases could dampen the benefits of higher exports. Increase in oil prices would be particularly serious, if weather conditions in Sri Lanka are adverse and droughts during the course of the year reduce rainfall that would decrease hydro electricity generation and increase oil imports, while reducing food crop production as well.

Domestic politics

Domestic political conditions, too, could have an adverse impact. With provincial council elections likely during the early part of the year and even the possibility of a Presidential election this year, economic concerns may take a back seat, there could be disruptions in economic activity and unproductive government expenditures could balloon. Added to this is the anxiety of the UN Human Rights Council sessions that would distract attention from the country’s economic concerns.

Bright spots

The three bright spots of 2013 that are likely to improve this year are the improvement in exports, enhanced workers’ remittances and earnings from tourism. The trend is likely to continue and boost the economy significantly and result in a balance of payments surplus. Wisely managed, it affords an opportunity to enhance the country’s foreign reserves and even reduce foreign debt or at least provide the opportunity not to increase foreign debt that is becoming increasingly burdensome.

More foreign borrowing

However the Government has announced its intent to offer a sovereign bond issue of US$ 1,500 million this year. This issue is likely to be subscribed at a higher interest rate than before, as the country’s ratings are lower. In addition, the inflow of such a large sum can appreciate the exchange rate and reduce the country’s competitiveness, especially because exchange rate management has not been in the interests of exports. All in all, such borrowing is a retrograde measure and should be avoided in the long term interests of the country.

Threats

Threats to the economy arise from an escalation of oil prices and possibility of drought that would not only reduce food production but also reduce hydroelectricity generation. Increased imports of oil at higher prices could negate the gains from exports. In any event, policies to curtail imports of non-essential intermediate imports and investment imports are needed to improve the trade balance. Containing aggregate demand is the best way to achieve this. The expenditure on infrastructure needs to be contained to achieve lower investment goods import expenditure.

Avoiding complacency

It is essential that the gains in exports and the external inflows from tourism, workers’ remittances and other capital inflows do not lead to complacency that result in higher import expenditure and investments in low yielding infrastructure projects. The lack of concern in increasing foreign borrowing and proxy borrowing for the Government by state banks have become threats to external financial stability by increasing foreign debt and placing the country on a path to a debt crisis.

Economic fundamentals

Economic fundamentals

The disregard for healthy economic fundamentals in domestic policy is a serious concern for sustainable economic development. The idea that fundamental and basic laws of economics could be flouted with impunity is a dangerous course that could lead to economic disaster. Ensuring a lower fiscal deficit, manageable trade deficit, providing an environment conducive for investment, lesser state control of the economy, liberalising trade and undertaking administrative and economic reforms are essential for economic growth.

Although there is rhetorical acceptance of pruning the fiscal deficit, the real fiscal outturn is far above a healthy level and higher than the target. This is especially so as the official figures of the fiscal deficit do not take into account the contingent liabilities of the Government through bank borrowing. While hoping that global developments would be favourable, there is a need for the appropriate responses that would mitigate the adverse impacts of external shocks and exploit to advantage the gains from trade, tourism and favourable international development.

There is a vital need to undertake reforms that would enhance the efficiency of the economy and develop an environment conducive to private investment both domestic and foreign.