News

Duped depositors relate their tales of woe

For someone who has been paralysed most of his adult life, Nanda Munasinghe maintains a surprisingly cheerful countenance. But it is becoming harder by the day. Sixteen years ago, the former seaman suffered spinal damage while diving in Ratnapura. A keen sportsman, he had played rugby for Isipathana College. The accident turned his life—and that of his wife, Sayuri—upside down.

Nanda Munasinghe:In constant pain without treatment Pix by Athula Devapriya

In 2011, they gained new hope when Nanda underwent a stem cells transplant. “I felt much better than before,” he said, lying prostrate on his bed. “The damage was reduced to a great extent.”

Nanda subsequently needed stem cells therapy at the Mount Elizabeth Hospital in Singapore which doctors said would cost around Rs. 1 million. That was affordable because they had money in fixed deposits at Central Investments and Finance (Plc) or CIFL.

First, Nanda needed to be examined by doctors at Mount Elizabeth and the trip was organized for April 2013. A close relative had advised Sayuri to save with CIFL because he was employed there. He took her certificate and promised the cash in three days. Then he stopped taking her calls. Although many depositors didn’t yet know it, the finance company was already in deep crisis.

Nanda and Sayuri cleaned out an emergency account and went to Singapore. That money had been set aside in case he needed urgent hospitalisation. Doctors at Mount Elizabeth confirmed that the operation would cost around Rs. 1 million. On their return, Sayuri sent her mother to CIFL to withdraw the Rs.1.5 million they had there. She was turned away.

With no interest payments from CIFL and no immediate possibility of withdrawing the capital, Nanda and Sayuri exhausted their other savings. As his sole caregiver, Sayuri is unemployed. They have no children. They live in a rented house on the outskirts of Colombo for which they have to pay Rs. 23,000 a month. Her mother advances her the money

“I used to have at least Rs. 10,000 in the house for emergencies,” she said. “There are times now when I don’t even have a Rs. 100. I can’t sleep. The bills are mounting. We live on handouts from my parents and from friends who have so generously collected money for Nanda.”

Nanda is in constant pain. Without treatment, he gets severe headaches which cause him to paw at one side of his face in agony. He has stopped some of his medicines because he cannot afford them. He no longer takes his nerve stimulation tablets which cost them Rs. 8,000 a month. His nourishment plan—which included fresh milk, fruits and laxatives to ensure healthy bowel movements—has been abandoned. There is no more physiotherapy.

Kusuma de Zoysa: Sold her wedding ring and earrings in desperation

“I have repeated urine infections which need intravenous treatment,” Nanda said. “I caught an infection recently through my catheter. The medicines cost Rs. 5,000 a bottle. Sometimes, my doctor gives me samples. This time, friends pooled in to buy me some bottles. I have nobody left to ask.”

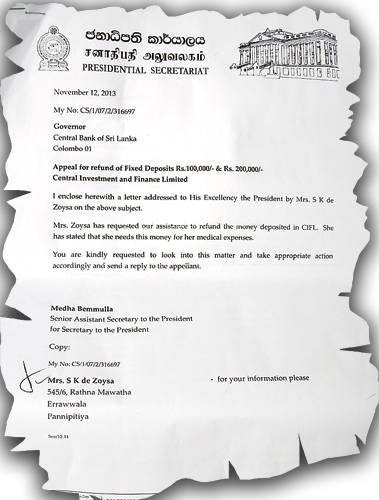

Like other anguished depositors of CIFL, they have sent letters to President Mahinda Rajapaksa in the vain hope that he would intervene. These have been referred to the Central Bank of Sri Lanka—the institution they hold largely responsible for the collapse of CIFL.

“We checked whether CIFL was registered with the Central Bank,” said Sayuri. “That was the primary reason for placing our money there because the Central Bank had waged a long campaign asking people to go only to registered finance companies.” The other factors that gave them confidence cricketer Sanath Jayasuriya’s backing and Sri Lanka Broadcasting Chairman Hudson Samarasinghe’s daily endorsements of CIFL.

But Nanda’s story is only one among many. The CIFL Deposit Holders Association continues to receive letters from people, many of whom are old and sick, desperate to get their money back. And the police, including the Fraud Investigation Bureau, are still taking complaints.

The Sunday Times interviewed a seriously ill cancer patient in hospital. He was in his eighties, did not want his name used and did not disclose how much he had saved at CIFL. “I’m old and very sick,” he rasped. “What use are these details? I am depending on my children now to support me. Do you know what is happening to the money?”

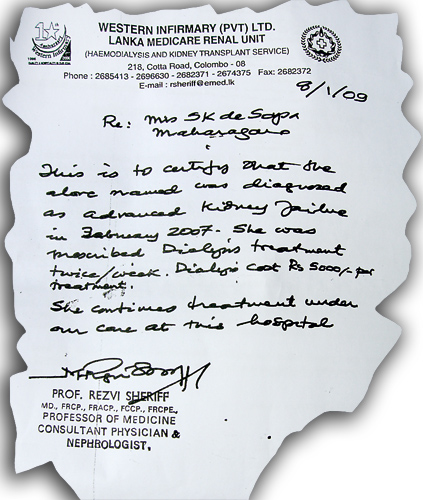

Last week, 85-year-old Kusuma de Zoysa sold her wedding ring and earrings for Rs. 35,000 to pay for medicines used to treat kidney disease. She is a widow and has no children. She is living temporarily with a relative.

Kusuma had started out as a nurse, working in government hospitals in Colombo, Anuradhapura and Jaffna. She left to become a matron lecturer for the Department of Agriculture. He husband was a divisional marketing officer for the Marketing Department. He passed away in 1986 in a terrible quirk of fate.

“I went on a pleasure trip to England,” she recounted. “The LTTE exploded a bomb in the Air Lanka plane on which I was supposed to return. My husband thought I had been on that flight. The next day, he suffered a heart attack and died.” Kusuma was referring to Air Lanka Flight 512 which had arrived from London at the Bandaranaike International Airport, only to be ripped apart by a terrorist bomb. Twenty-one people were killed and 41 injured.

Kusuma: Appeal letters have had little response

As luck would have it, Kusuma missed that flight by extending her trip by a few days. She had written to her husband but he hadn’t received the letter. It was only when she returned to Sri Lanka that they told her he had died. Tears well up in her eyes while recalling the tragedy.

Thereafter, her life was filled with travails. She says many people took advantage of her, leaving her penniless in the end. She had no house and lived on rent in many places. “I had a lot of money including my EPF and other savings,” she narrates. “My husband did export business after he retired. We were to buy a house when I returned from London.”

In June 2012 Kusuma, having seen a newspaper advertisement, deposited Rs. 300,000 with CIFL. She managed to withdraw Rs. 25,000 when the company first went into crisis but the rest remains blocked.

She needs money now for living expenses and medication which costs here around Rs. 5,000 month. She went several times to CIFL to beg for money and was seen weeping in the lobby. She depends on her small pension but worries that she won’t be able to manage for much longer. She has had dialysis several times. Both eyes have been operated on. She also suffers from diabetes and was recently diagnosed with a heart murmur. Her medical tests are expensive.

Kusuma has written letters to the President and to everyone else she can think of, to no avail. “If get my money back, I can bank it and live on interest along with my pension,” she said. “I can manage. It’s ok if they give it to me even little by little. But how can I live like this?”