Columns

Beyond the Budget debate: Fundamental economic issues

View(s):The 2014 budget was passed by an overwhelming majority in parliament after a debate that brought out only a few relevant and constructive comments. The fundamental issues of the budget were mostly beyond the debate.

Budgets are the centrepiece of economic policy. It is not a mere statement of revenue and expenditure. It lays down the parameters within which the economy operates. It should be a precise statement of the Government’s strategy of economic and social development and the financial means by which it is implemented. For many years now the budget has not been so.

Furthermore, there has been an erosion of parliamentary control of public finances. Significant expenditures are incurred that are not approved in the Budget. Supplementary estimates are rushed through Parliament and expenditure overruns are recurrent features. The revenue estimates are not realistic and there are shortfalls in revenue collection. The Budget rhetoric is not matched by financial commitments. These render the Budget a piece of financial fiction.

Policy statement

The President reiterated several important features of government policy: “our Government will not privatise state enterprises or state banks as the Government firmly believes that state enterprises should have their presence in the economy for there to be a fair balance between the public sector and the private sector to ensure economic and social progress in our country.”

While a clear statement reaffirming government policy on privatisation was appropriate, the world’s fastest growing economies from China to India, Vietnam and Thailand have abandoned state ownership of business enterprises.

Improving investment climate

It would have been valuable if this statement could have been complemented with a guarantee that private enterprises would not be taken over by the Government. The acquisition of “loss making” private enterprises by the Government has cast a shadow on private investment and foreign direct investment. A firm statement followed by legislation guaranteeing safety of private investments could have improved the investment climate.

Without such an assurance foreign direct investments are likely to be confined mostly to investments like hotels and casinos rather than in manufacturing of tradable goods that could increase the country’s export earnings, lead to efficient import substitution and enhance technology transfers. Local investors are finding investing abroad more attractive and therefore establishing or contemplating establishing manufacturing plants abroad.

Rhetoric on agriculture

The Budget was emphatic on support for agriculture and rural development: “We consider that our rural-centric development strategy must focus on agriculture for food security, traditional healthy living, bio diversity, a clean environment and a higher income to the rural people.”

Despite the Government’s rhetoric to strengthen agricultural extension and other services, recent experience suggests deterioration of these. While the Government’s objective of enhancing support for agriculture is crucial, the institutional reality is different. Research, extension and other services have been weakened in recent years. The commitment to improve these articulated in the Budget Speech must be backed by adequate resources, rational reforms and depoliticisation. Research, extension and rural infrastructure improvements could make a useful contribution to increasing agricultural output, rural incomes and reducing food prices. However, there is a yawning gap between the rhetoric of supporting agriculture and the reality at grassroots where it matters.

Regressive taxation

The increase in taxation of basic foods that were not announced in the Budget, but soon after, is a serious concern. It is an affront to Parliament and a violation of parliamentary control of finances. This is another instance of the Government eroding parliamentary control of public finances.

The opposition focused on the inequity of taxes on basic foods, pointing out that they increase their prices and are a heavy burden on the poor.

Such taxation on basic food imports is being justified as a protection to domestic farmers, who have been already given high levels of protection. It is patently clear that increases in tariffs are mainly a revenue measure, while distorting relative prices that would lead to lower efficiency.

Fundamental issues

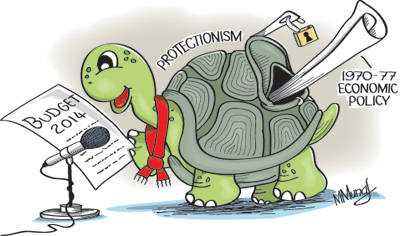

The Budget has raised fundamental issues with respect to the thrust and direction of economic policies. There appears to be a push towards inward-oriented economic policies, including trade protection. Although the budget considers export promotion as vital for the country’s development, its import substitution strategy can be inimical to an export-led growth strategy because of the bias against exports it creates.

An import substitution strategy that is expansive and extensive could harm export incentives and export growth. This is the lesson that years of import substitution, especially in 1970-77, should have taught us. It was the trade liberalisation in 1977 that led the country towards export led industrialization and a diversified and stronger economy.

Forerunner

Sri Lanka was the forerunner of liberalisation in South Asia. India, Pakistan and Bangladesh followed open economic policies that led to their strong economic performance. The former communist countries of Russia, China and Vietnam, recognised the need for the liberalisation of trade for economic growth and benefitted from these policies and continue to liberalise their economies. Although the empirical experience is so clear, there appears to be a return to inward looking autarkic policies that failed.

Furthermore, there are no measures to improve the policy environment in trade, regulation or reform of state enterprises that are essential to achieve productivity growth and economic stability to achieve an 8 per cent growth target.

Borrowing

Keeping the fiscal deficit down by borrowing is hardly acceptable as reducing the fiscal deficit. Reducing the fiscal deficit, while at the same time getting other state-owned enterprises such as state -owned banks to borrow, will not help with the macroeconomic adjustment to put growth on a sustainable basis.

These borrowings are a part of the Government’s contingent liabilities. Maintaining inefficient state enterprises by raising prices merely transfers the burden of inefficiency to the consumer.

In conclusion

The fundamental issues of economic policy direction, ensuring a climate conducive to private investment and avoiding regressive taxation and reforms to enhance state sector efficiency remain to be addressed. The Budget seems to signal a return to a failed strategy of protection.