Columns

Some silver linings in containing fiscal deficit

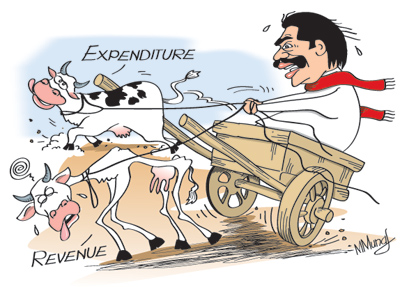

View(s):Three critical challenges of the 2014 budget were: containing the fiscal deficit, providing cost of living relief to the poorer sections and generating an environment conducive to higher investment. There is ample recognition of these in the budget recital, but whether the measures adopted would achieve the needed results is doubtful.

Today we discuss the challenge of containing the fiscal deficit. The broader issues of generating an environment conducive to higher investment, economic growth and poverty alleviation and the economic strategy implied in the budgetary proposals will be discussed next week.

Fiscal deficit

The Government was confident that the fiscal deficit target of 5.8 per cent of GDP will be achieved in 2013 and reiterated the Government’s intent of containing the fiscal deficit to 5.2 per cent of GDP in 2014 and reducing it further to 4.5 and 3.8 in 2015 and 2016.

Although the Government succeeded in bringing down the deficit to 6.4 per cent of GDP in 2012 from 6.9 per cent of GDP in 2011, it missed the target of 6.2 per cent last year. Will this story repeat itself?

It is difficult to achieve the fiscal deficit target of 5.8 per cent this year as expenditure has exceeded and revenue collection has been below expectations. A reversal of this trend in the second half is optimistic, even though government revenue will be higher later in the year, as government expenditure is likely to rise especially due to the large CHOGM expenses.

The fiscal deficit could be “reduced” to the target level of 5.8 per cent of GDP by deferred payments and debts to banks that are contingent liabilities of the Government not being included as part of the fiscal deficit.

Bright spots

There are some bright spots that lend hope to an improvement in the fiscal outcome. Losses of public enterprises have been a huge drain on public funds for many years. The Budget speech announced that of the 54 state-owned enterprises the number of loss making ones has been reduced to seven. The large loss-making enterprises, the Electricity Board (CEB) and the Petroleum Corporation (CPC) are likely to break even or show profits this year and would be reducing their liabilities to banks.

This has been confirmed by the latest figures that show a profit of Rs 16 billion for the CEB in the first 9 months and CPC has achieved a break-even point. These improvements would reduce the fiscal deficit by about 1 per cent of GDP.

Revenue may increase owing to the application of the Nation Building Tax (NBT) of 2 per cent to banks. Besides this, the lapsing of exemption of taxation of BOI enterprises should increase tax revenues. These two measures are good sources of revenue as there would be no evasion or tax avoidance and the efficiency of the tax administration will not matter.

Increasing revenue

The huge challenge facing the Government is to increase tax revenues that have been declining as a proportion of GDP despite high economic growth and increasing per capita incomes. In 2012 revenue as a percent of GDP fell to as low as 12 per cent. In 2014 the budget estimates expect revenue to rise to about 12.4 per cent of GDP. For a country at Sri Lanka’s middle income level revenue should be about twice its present level.

The large amount of tax exemptions, tax avoidance and tax evasion and weak tax administration are responsible for inadequate revenue collection. One is sceptical about the computerisation of the Inland Revenue Department being the panacea to these problems.

Taxing the poor

Low tax revenues have resulted in imposition of taxes on basic food imports that are a heavy burden on the poor. The expectation that this regressive taxation burden is shifted to the more affluent whose conspicuous luxury consumption should be taxed has not been realised. In fact higher or new taxes have been imposed on several basic food items whose incidence would fall heavily on the poor and affect their livelihoods.

In contrast taxes on goods consumed by the affluent have been reduced. The rationale for this in the light of the budget rhetoric is difficult to comprehend. There is a strong rationality in indirect taxation of the rich as there is a high degree of tax evasion by rich professionals and efforts to bring them within the tax net has met with little success.

Expenditure

The Government faces stiff challenges to contain the fiscal deficit owing to the substantial increases in expenditure on promised extensive benefits as well as the conspicuous spending of the Government. Containing expenditure in a situation when wages are increased in a bloated public sector, expensive public sector investment in infrastructure development continuing, subsidies increasing and financing huge losses of public enterprises such as the two national airlines is difficult. Pruning some of these expenditures are needed to contain public expenditure.

The increase in salaries and wages in the public sector is a partial adjustment for the high cost of living. Yet this large expenditure would be a further strain on the public finances. The high investment in infrastructure not only is a reason for the high fiscal deficit, but also for the widening of the trade deficit.

As pointed out last week, apart from the overall financial outcomes, there are concerns of inadequate expenditure in priority areas and ensuring taxation is not regressive and a burden on the poorer sections of the community. The increase in import duties on food items is a burden on the poor and should have been avoided.

In conclusion

The containment of the fiscal deficit is an important objective that must be pursued to sustain economic growth. Yet it is unlikely to be attained given the recurring shortfalls in revenue and the overruns in expenditure. The budget proposals for 2014 are not likely to achieve the goal of mobilisation of adequate revenues, on the one hand, and curtailing expenditure on the other, to achieve the targeted fiscal deficit. However the reduction of losses in public enterprises and the NBT are likely to enhance revenue.

The 2014 budget has once again raised fundamental issues with respect to the thrust and direction of economic policies. There appears to be a push towards inward oriented economic policies, including trade protection, rather than export led growth. This all important issue for economic development will be discussed next week.