Columns

Reducing fiscal deficit vital for economic stability and growth

View(s):Containing the fiscal deficit to 5 percent of GDP is vital to achieve economic stability and growth, prevent the public debt from escalating to an unsustainable level and avert a balance of payments crisis. Today we explore the reasons why successive governments have found it difficult to contain the fiscal deficit to the announced targets.

The need to consolidate the country’s public finances was stressed by the recent IMF mission. Time and again the Central Bank has stressed the need to bring down the fiscal deficit so that monetary policy could be more effectively used to promote economic growth. The country’s think tanks: The Institute of Policy Studies, The Pathfinder Foundation, The Point Pedro Institute of Development Studies and independent economists have all stressed the need to bring down the deficit. The Treasury too accepts the need to keep to the announced fiscal deficit targets.

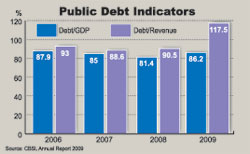

Despite intentions, assertions and targets to bring down the fiscal deficit, the decreases in the fiscal deficit have been inadequate. Consequently the public debt has been increasing and reached 81 percent of GDP at the end of last year.

Past experience

The Fiscal Management Responsibility Act (FMRA) passed by parliament in December 2002 made it mandatory for the Government to take measures to bring down the fiscal deficit to 5 percent of GDP in 2006 and kept at that level thereafter. As it turned out, The Fiscal Management Responsibility Act has been observed in the breach.

The fiscal deficit averaged 8 percent of GDP in the five years (2004-2008). There has been some progress in bringing down the deficit in recent years. In 2011 the deficit was brought down to 6.9 percent of GDP and will perhaps be about 6.4 percent last year. In both these years the targets of bringing down the deficit was exceeded by a few decimal points.

Current concern

The IMF has once again brought to the fore the fundamental weakness of having a large fiscal deficit. While commending the Government for having brought down the fiscal deficit in recent years and the commitment to contain the deficit at 6.2 percent of GDP, the IMF said it was unlikely that this target would be achieved. Nevertheless even the containment at a little above this at about 6.5 percent of GDP is commendable considering the lower level of economic activity and GDP growth.

The IMF mission chief said the Government had cut capital expenditure and deferred cash payments to come close to the 6.2 percent of GDP budget deficit target last year, but that it is likely that the deficit would be higher. Even this is being achieved by deferring payments, not making payments to state banks and other methods of ‘creative accounting’. Besides,this the fiscal deficit is brought down statistically, by massaging the GDP growth estimate from about 5.8 percent to about 6.5 percent.

Unless there are meaningful measures to increase revenue and curtail expenditure, especially of mega infrastructure projects, achieving the 5.8 percent of GDP target this year would be difficult. The leader of the IMF mission said that sticking to this target would help the economy reduce its already high debt-to-GDP ratio and help the Central Bank to conduct its monetary policy which would keep inflation down.

Increasing revenue

There is a need to increase government revenue that is on a declining trend. The tax GDP ratio has declined in 2012 to 11 percent of GDP — less than half of other countries with similar GDP per capita. The IMF prescribed the expanding of the tax base, reforming revenue administration and introducing an automatic price adjustment formula for energy. These, the IMF said, were crucial if the Government was serious about continuing with the infrastructure development programme without accumulating too much debt.

The revenue to GDP ratio of only 11 percent is an unacceptable level for a country at the current level of per capita income. It should be around 24 percent of GDP. If this were achieved it would make a significant difference to the reduction of the deficit. However, this appears to be a tall order as the administrative machinery is too weak to reduce tax evasion and tax avoidance.

It is well known that professionals avoid taxes in many different ways. Businesses too are quite adept at ensuring that they pay only a fraction of their tax dues. A root cause of this is the administrative indifference, inabilities and corruption.

The COPE clearly stated that corruption was the fundamental reason for the low recovery of tax dues. In such a situation a more innovative means of taxation that succeeds in taxing those who avoid taxes through indirect taxes whose incidence falls on these tax avoiders is a more realistic means of tax collection. Increasing taxes on small motor cars and decreasing taxes on large luxury vehicles is unlikely to achieve this.

Government expenditure

There are very many actions needed on the expenditure side. Losses in public enterprises should be reduced especially with respect to the two large state institutions, the CPC and the CEB. The IMF suggested that this be achieved by price and tariff increases.

While this is one method, it should be complemented by improving the efficiency of these institutions. Improvement of efficiency of state enterprises could reduce public expenditure to make good the losses. However, it is difficult to reduce losses as there are political interventions in the running of such enterprises. Nevertheless, every effort should be made to enhance their efficiency and reduce losses.

Reducing expenditure

Reduction of wasteful government expenditure is important. These are so blatantly clear and common knowledge that it is not necessary to mention them. There appears to be a notion that government has an inexhaustible supply of finances and that therefore there is no need for prudence in expenditure.

The essence of economics is that resources are scarce and that they must be used in the most effective and economic manner. If this were not the reason for imprudent expenditure, then it must be the political advantages and personal benefits that make the Government incur exorbitant expenditures. Such wasteful imprudent expenditure is an important reason for high fiscal deficits.

Infrastructure expenditure

One of the achievements of the government has been the improvements in infrastructure that have been neglected over the years. Roads, bridges, culverts, sports complexes, fisheries harbours and ports and airports have been built. Nevertheless all infrastructure development is not necessarily justified from an economic perspective. The costs of infrastructure projects, their import content, their benefits and gestation periods must be evaluated. Neglect of these could lead to both a fiscal burden as well as a drain on foreign reserves.

Infrastructure projects that either save or earn foreign exchange are the least burdensome to the balance of payments. Prioritisation of infrastructure development on this criterion is a prudent economic strategy. Otherwise the debt servicing costs would escalate to create a further strain on the balance of payments.

The balance of payments difficulties created by large government investment projects underlie the need to prioritise investments in consideration of foreign costs, export earnings and import savings. Furthermore as large infrastructure projects have long periods of gestation it is important to phase them over time so that the fiscal burden and balance of payments strain is minimised. The large expenditure on infrastructure development is to a significant extent responsible for both high fiscal and trade deficits.

Political will

Public finances of the country must be with due recognition that the government does not have unlimited resources and that prioritisation of expenditure is vital to avoid large fiscal deficits, increase public and foreign debt and balance of payments difficulties. There should be a realisation that incurring debt adds to inflation, destabilises the economy and affects economic growth adversely. Astrong political will is necessary to reduce unnecessary and wasteful public expenditure.

Follow @timesonlinelk

comments powered by Disqus