Govt. has overspent, borrowed too much this year-BT poll reveals

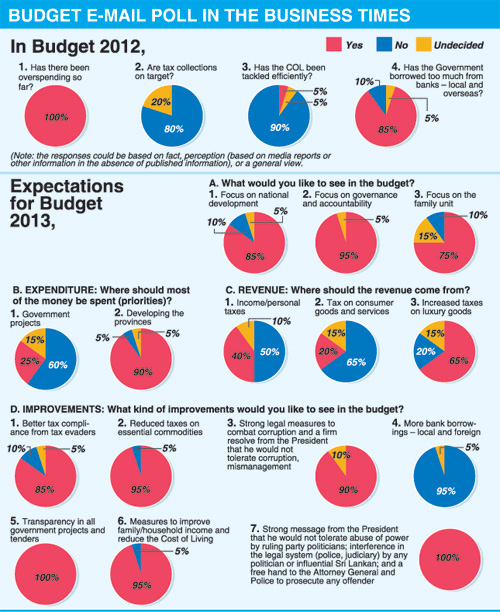

View(s): There was near unanimity in the Business Times (BT) email poll of 400 respondents on overspending, low tax collections, ineffective ways to tackle cost of living and too much borrowing from here and abroad, in the 2012 budget. Asked whether there has been overspending so far in the 2012 budget, the response was a 100 per cent YES, while 80 per cent said tax collections are not on target, 90 per cent agreed that the COL has not been tackled efficiently and 89 per cent said the Government has borrowed too much from banks – local and overseas.

There was near unanimity in the Business Times (BT) email poll of 400 respondents on overspending, low tax collections, ineffective ways to tackle cost of living and too much borrowing from here and abroad, in the 2012 budget. Asked whether there has been overspending so far in the 2012 budget, the response was a 100 per cent YES, while 80 per cent said tax collections are not on target, 90 per cent agreed that the COL has not been tackled efficiently and 89 per cent said the Government has borrowed too much from banks – local and overseas.

On expectations in the 2013 budget, the sentiment was similar on the need to focus on national development, governance and accountability and the family unit. The YES rating was high in the call for more spending in the provinces than Government projects, reduced taxes on consumer goods and services, and better tax compliance from tax dodgers.

Respondents favoured a firm resolve from the President that he would not tolerate corruption and, mismanagement and a strong message in the budget that he would not tolerate abuse of power by ruling party politicians and interference in the legal system (police and the judiciary). The graphic of the poll is given here.

Listed below are comments from respondents:

Budget 2012

- Current spending upto April is up 23.6 per cent against a general 10 per cent increase for the whole year.

- Taxes forcibly extracted from the people are only up 10.7 per cent against a very ambitious 23.6 per cent set in the budget for whole year. With an import slowdown on cars, revenues will be hit. However lower oil prices may help increase excise taxes from petrol and even some diesel.

- The rupee fall has increased inflation. However monetary policy is now aligned with an appreciation of the currency. Hopefully future price increases will be lower.

- Borrowing has increases especially from local banks. Even though car buyers have been blamed, credit by state enterprises was up 107 per cent to May and credit to the Government was up 44.7 per cent. Private sector credit rose only up 33.5 per cent in the 12 months to May. The private sector is a net saver so they can borrow more from fellow citizens without disrupting the economy, unlike the Government which is the other way round.

- There is ‘big government’ and large scale waste and corruption. The numerous state owned enterprises (SOE) are mismanaged and are making huge losses. The budget deficit has to be reduced to about 3% of GDP.

- Essential infrastructure development is a good investment and borrowing is justified, in this context. However we are also borrowing to subsidise loss-making state enterprises and for consumption.

- There is widespread tax evasion ; many businesses do not issue official receipts and corruption is suspected in the collecting institutions. These are politicized issues and merit in recruitment is ignored. Wrongdoing in this country is not punished as there is no independent judiciary.

- The government debt of 76 per cent of GDP is too high as debt repayments consume a greater part of revenue and further borrowing is necessary. The country doesn’t attract sufficient non debt investment especially FDI in the absence of a positive investment climate including good governance, the rule of law, predictable policies and an ease of doing business.

On expectations in Budget 2013: - Focus on economic stability and reduce borrowings. Rulers must live within their means. Maintain rule of law by avoid arbitrarily tax changes within budgets. Abolish the midnight gazette tradition.

- Combating corruption is not a budget issue. This is an overall people’s civil freedom issue that must be fixed through the constitution and the restoring the independence of the public service. It can be done at anytime if there is sufficient pressure from the people and a receptive opposition

On spending: - The Central Bank has refined the fine art underwriting high yield (junk) bonds. They underwrite new issues to pay-off previous ones. We as a nation will perpetually be in debt if we raise so called sovereign bonds on a quarterly basis and claim that it was oversubscribed many folds: The bond mechanism is not within the comprehension of the average citizen. However, unfortunately though, the repayment of these bonds becomes their responsibility. The true nature of these bonds must be explained and more importantly, when it comes to the dispensing or utilising of these funds we must have a process to monitor if the funds were allocated for the right purpose it was raised. In 2007/8 when the first US$500 million was raised it was stated the funds were to be used for development projects. But the Governor claimed he allocated $ 300 million to import duty free cars for the medical professional.

- All expenditure must be pruned justifying its use. Political expenditure cannot be from public funds of the people. This is brazenly flouted!

- Article 151 of the Constitution implies that the President and Minister of Finance should be two different persons.

- Do not discriminate between provinces and big cities. If there is a deficit in infrastructure fix it. However cost benefits may be higher in areas with more population density.

- If the highways are developed and BOI controlled industrial zones are demarcated, private investments will develop the provinces

- Improve productivity of agriculture to raise incomes of the rural population, reduce prices of essential food and export more goods.

On revenue:

- No harm in raising taxes but our rates are already on par or higher than other countries.

- Rulers cannot decide what a luxury good is. We did not get independence from the British to allow the ruling class to decide what luxury is or not. They get luxury goods as a routine exercise. Nobody has right to decide what is a luxury for citizens.

On budget improvements: - Lower the number of taxes to income tax, sales tax. one or two sets of import duties as low as possible. Increase general sales tax rather than import duties. No ad hoc cess.

- We have high protectionist taxes on basic foods. Bring it down to a normal 20 per cent VAT, irrespective of whether imported or not. The freedom of choice of food of the people instead of decisions made by nationalists and farmers must be restored.

- Micro level intervention by the President in implementing laws shows the system has broken down. The system must work on its own. Restore the independence of the Attorney General’s office. The Finance Ministry should be handled by another politician who can be held accountable.

- The President should not have portfolios similar to the status of the present Prime Minister. He should be the class monitor and supervisor of ministers.

- Mere statements of transparency won’t work; there should be politically neutral institutions, recruitment of officials on merit and an independent judiciary according to the 17th amendments to the constitution without which the country can never protect the democratic rights of the people and attract investments for growth

- Restore rule of law, have independent commissions and/or permanent secretaries with a civil service commission. Otherwise a transparency undertaking (by the President) is a pipe dream.

- Rule of law means, that we are ruled by the law and not by Governments, Dictators or Monarchies!

- Interference with or compromising the independence of the judiciary must be by example by the very top!

- Hope Sri Lanka will not be another Greece, face liquidity issues and end up not being able to repay these huge borrowing.