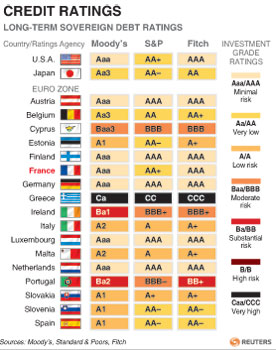

BERLIN/ATHENS, Jan 14 (Reuters) - Standard & Poor's downgraded the credit ratings of nine euro- zone countries, stripping France and Austria of their coveted triple-A status but not EU paymaster Germany, in a Black Friday the 13th for the troubled single currency area.

“Today's rating actions are primarily driven by our assessment that the policy initiatives that have been taken by European policymakers in recent weeks may be insufficient to fully address ongoing systemic stresses in the eurozone,” the U.S.-based ratings agency said in a statement.

In a potentially more ominous setback, negotiations on a

debt swap by private creditors seen as crucial to avert a Greek default that would rock Europe and the world economy broke up without agreement in Athens, although officials said more talks are likely next week.

If Greece cannot persuade banks and insurers to accept voluntary losses on their bond holdings, a second international rescue package for the euro zone's most heavily indebted state will unravel, raising the prospect of bankruptcy in late March, when it has to redeem 14.4 billion euros in maturing debt.

S&P cut the ratings of Italy, Spain, Portugal and Cyprus by two notches and the standings of France, Austria, Malta, Slovakia and Slovenia by one notch each.

The move puts highly indebted Italy on the same BBB+ level as Kazakhstan and pushes Portugal into junk status.

It put 14 euro-zone states on negative outlook for a possible further downgrade, including France, Austria, and still triple-A-rated Finland, the Netherlands and Luxembourg.

Germany was the only country to emerge totally unscathed with its triple-A rating and a stable outlook.

French Finance Minister Francois Baroin, speaking after an emergency meeting with President Nicolas Sarkozy, played down the impact of Europe's second-biggest economy being downgraded to AA+ for the first time since 1975.

“This is not a catastrophe. It's an excellent rating. But it's not good news,” Baroin told France 2 television, saying the government would not respond with further austerity measures.The euro fell by more than a cent to $1.2650 on the news. European stocks, which had been up for the day, turned negative, but reaction to the widely anticipated news was moderate. Safe-haven German 10-year bond futures rose to a new record high while the risk premium that investors charge on French, Spanish, Italian and Belgian debt widened.

Euro-zone finance ministers responded jointly by saying in a statement they had taken “far-reaching measures” in response to the sovereign debt crisis and were accelerating reforms toward stronger economic union.

|