The Pension Scheme for Private Sector Employees proposed by the government in the Budget for 2011 met its destined fate as it was an ill- conceived, ill prepared and sought to be implemented without proper consultation with concerned parties. The tragic loss of life of a young worker Roshan Chanuka put paid to the scheme of the government to organise a captive fund to be at its disposal. As per its provisions no benefits accrue to the contributors for the first 10 years or so.

The government made out to the country that it was a good intentioned measure to meet the growing demographic challenge by providing income security to the aged population that has to be cared for in the evening of their lives. However the various provisions in the draft legislation told a different story as was pointed out by the trade unions that successfully defended the hard earned earnings and savings of workers.

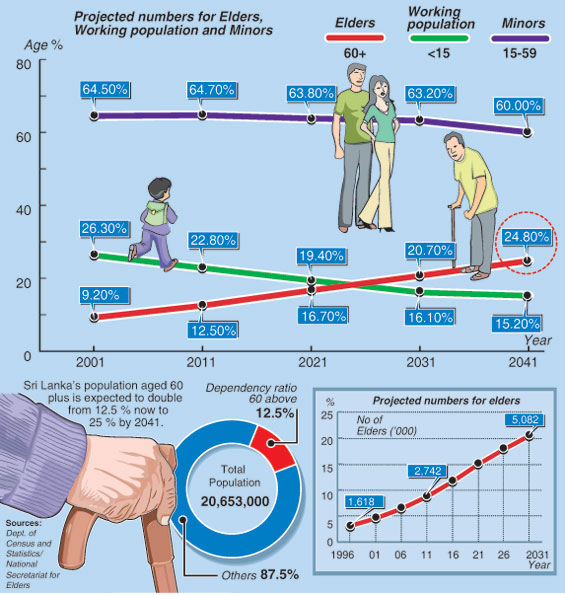

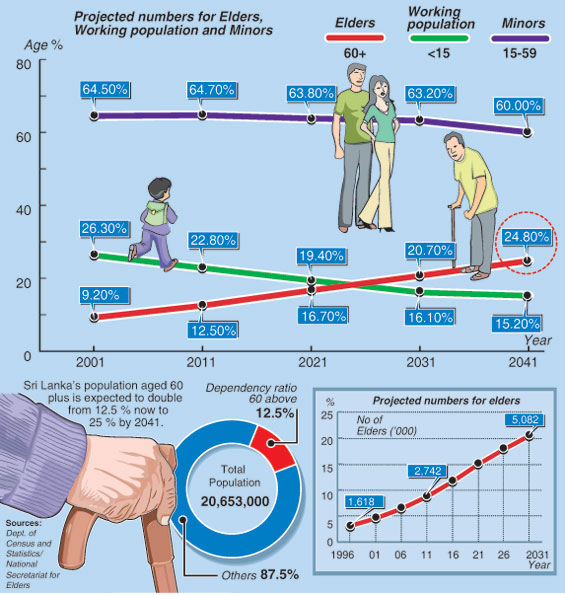

The government could have if it was so keen to ensure economic relief during old age looked into other options without tampering with the hard-earned earnings and savings of beleaguered workers in the private sector. According to demographic projections, the share of Sri Lanka’s population aged 60 plus is expected to double from 12.7 % now to 25 % by 2041.

Access to a reliable source of income in old age has to be recognised in Sri Lanka consistent with other countries to have an important bearing on poverty and standards of living. Extending income security coverage to the entire elderly population is a challenge which will require concerted national efforts, commitment and strong political leadership.

If Sri Lanka is to be successful in tacking old age poverty there has to be a radical shift in thinking as to how best to bring about income security for the vast population of the older generation. International experience indicates that in countries with high levels of informal employment and poverty the most effective form of pension is a universal non-contributory pension paid out of government revenues. In such pension schemes, every older person, upon reaching a specific age, receives the same minimum benefit to keep them out of poverty. Over 60% of our economy is occupied by the informal sector where security of employment and obtained income savings and statutory entitlements and right at work are absent or minimal.

The Ceylon Federation of Labour (CFL) had the opportunity to attend a workshop conducted by HelpAge Sri Lanka in 2008 at which a study on Tackling poverty in old age - A Universal Pension for Sri Lanka was presented. This study provides estimates of the fiscal cost of a universal pension in Sri Lanka. It challenges those opponents of universal pension who claim that such pensions are unaffordable, despite the fact that many developing countries have already successfully put in place such scheme.

hose who retire due to old age particularly in the private/informal sectors have nothing to fall upon and, with the disappearance of the extended family system they are placed in dire straits. The report mentions a range of countries as diverse as Mauritius, Nepal, Namibia, Bolivia, and Kosovo that have established similar schemes. The study demonstrates that a universal pension in Sri Lanka can be affordable. The study proposes a level of cash benefit for a universal pension in Sri Lanka at the national poverty line. The study estimates the cost of a pension for four qualifying ages: 60, 65, 70 and 75 years. The study also indicates the pension for everyone over 60 would cost 1.8% of GDP for those over 60 it would be 1.2% of GDP’ and for over 75s it would be 0.4% of GDP.

Presently, those older than 60 years of age number approximately 02 million. As their number is bound to increase in the coming years the older people will become a powerful group and government will have to take note of them by responding to their demands, including the demand for a basic pension.

The founding fathers of the Left movement in the county inscribed on the manifesto of the LSSP in 1935 old age benefit and espoused it in every process they took part in .

The late Dr. N.M. Perera when he became Finance Minister in the UF Government while proposing a contributory pension scheme for new entrants to government service announced a universal pension for the old. But the entire scheme came to be subverted by the satanic forces at work at that time. The problem is now assuming serious proportions and action is needed now and any procrastination or fiddling with hair-brained schemes like the ill-fated pension scheme for private sector employees would only exacerbate the plight of the old .

Existing social assistance schemes provide no viable solution to the elderly. The Samurdhi Scheme provides income support to the poorest older people who belong to households with monthly income less than Rs. 1,500 a month. The Samurdhi scheme pays benefits ranging for Rs. 250 for one person households to Rs 100 for a household of six or more people. Under the Public Welfare Assistance Programme even less is paid at Rs.100 a month for a single person and a maximum of Rs. 300 for a family with four or more persons. Recently it has been announced that those aged 80 years would be entitled to receive an allowance of Rs. 1,000 per month. All these are only a tiny portion of the national poverty line. Every older person needs to receive a basic pension, one that is aimed at keeping them out of poverty. The level of the benefit should therefore at least be equivalent to the poverty line.

Financing of a universal old age pension is a question of political will. If the government wants to implement a pension it will be able to find the necessary finance. For a start every one over 70 years of age can be made entitled to a non- contributory pension. Since everyone benefits from universal old age pension it is important the whole society comes forward to finance the pension. There needs to be some increase in taxation and the revenue so collected has to exclusively be set aside for the purpose of universal pensions if it is to receive the ready willingness of the tax payers. The HelpAge study asserts that consumption taxes are one option in Sri Lanka. A part of the VAT and excise duties could provide sufficient funding to finance a universal pension for everyone over 70 years of age. Opting for such a scheme is far better than tampering with hard earned savings of workers .

|