The most notable aspect of the recovery following the Global Financial Crisis (GFC) has been the extraordinary rebound in profitability of most firms around the world. The GFC hit at a time when most non-financial companies were in excellent shape, after years of post-communism reform in which they evolved into profit machines of extraordinary efficiency and adoptability. Corporate profit margins are reaching outstanding levels. In America, earnings margins are at their highest levels in years.

The dichotomy is that high corporate profitability hasn’t alleviated the global unemployment problem.

Most policy measures around the world have tended to subsidize the demand for capital rather than the demand for labour. Investment tax credits (whichever name it goes by) makes the demand for capital cheaper – relative to the demand for labour – and leads to a substitution of labour for capital. The problem in the U.S. is not the lack of capital spending, since the second quarter such spending was running at annual growth rate of 25%; rather, the trouble stems from the lack of demand for labour and job creation. The dichotomy is that high corporate profitability hasn’t alleviated the global unemployment problem.

Most policy measures around the world have tended to subsidize the demand for capital rather than the demand for labour. Investment tax credits (whichever name it goes by) makes the demand for capital cheaper – relative to the demand for labour – and leads to a substitution of labour for capital. The problem in the U.S. is not the lack of capital spending, since the second quarter such spending was running at annual growth rate of 25%; rather, the trouble stems from the lack of demand for labour and job creation.

The old school logic that increased capital spending leading to higher employment, simply does not apply to the current realities of the world economy. In the current environment, the majority of capital spending is labour saving: firms are investing in capital goods and software/equipment – and off-shored back offices – that allows them to produce the same amount of goods with a lower input of labour. While the off-shoring trend may create a temporary rally in employment markets in destination countries (such as Sri Lanka), it remains a temporary stop on a continuum of technological advancement which have begun to have a negative bearing on white collar jobs. Traditional economists are yet to be convinced that advancing technologies can have a long term impact on unemployment. This creates a policy vacuum for governments with a lack of advice on reforms that are crucial to ensure a balance between advances in technology (exclusively added through tax breaks on research and development) and jobs growth in the real economy.

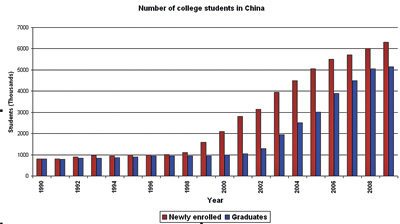

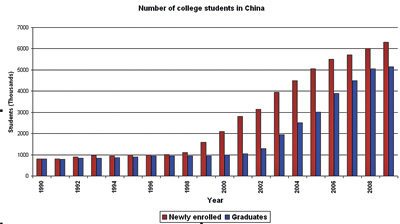

The future of job creation is crucial to households who have to make significant financial decisions with regards to higher education. As highlighted in the previous column, rising tuition costs and declining white collar job availability together with a lack of real growth in wages have made a paid university degree (at second and third tier levels) less attractive today than at anytime in the past 30 years. This fact is compounded by two phenomena in the rising number of “graduates” in China and the demographic profile of India over the next two decades. The future of job creation is crucial to households who have to make significant financial decisions with regards to higher education. As highlighted in the previous column, rising tuition costs and declining white collar job availability together with a lack of real growth in wages have made a paid university degree (at second and third tier levels) less attractive today than at anytime in the past 30 years. This fact is compounded by two phenomena in the rising number of “graduates” in China and the demographic profile of India over the next two decades.

An unintended consequence of the exponential rise in enrolment in higher education in China has been the refusal of graduates (of even dubious institutions) to take up certain jobs which they deem to be “beneath” themselves, thus fuelling a major wage explosion in blue collar jobs. Everyone it seems espouses to be sitting in a concrete tower. This bonanza in demand has not only given employers ample choice of candidates, but the ability to keep a tight lid on wages for office workers.

However, this trend may not last beyond the next 15 years as China starts to age and its one-child policy bites into economic growth. The impact of the one-child policy is so perverse that according to some statistics a number of Chinese no longer need to work during this generation. Owners of “luxury brands” are licking their fingers at this prospect and Daimler, a vehicle manufacturer, now sells 60% of their S-class Mercedes (the most expensive) in China. This generation of Chinese have been patronisingly dubbed “little emperors” by Western advertising agencies.

India has no such population complexities. In 2020 the median age in India will be 28, compared with 38 in America, 45 in Western Europe and 49 in Japan. A recent report by Goldman Sachs, an investment bank, suggests that more than 110 million Indians will join the workforce over the next decade. A significant increase in college educated workers in both India and China will invariably put severe pressure on an already shrinking white collar jobs pool, thus leading to a significant diversion in the wealth distribution over the next 15 years.

The results of this transformation are there for all to see in Sri Lanka itself. A year and a bit after the end of the war, the vast majority of job creation in the country has been in the blue collar sector. While this is unsurprising (major wars are followed by reconstruction activity in affected areas which are inherently blue collar jobs), the job creation (or lack of) around the other provinces point to disappointment for white collar jobs. The sector with the largest rise in employment has been tourism, a high touch service sector which requires a vocational qualification and not a four year university degree. More surprisingly, the wages growth of tradesmen (carpenters, electricians and cement renderers) has outstripped the wages growth of all white collar professionals in Sri Lanka over the last year, pointing to a very clear supply imbalance. While the muliplier effect will eventually begin to create more white-collar jobs, it remains muted in the near term and under threat in the long term by advances in technology.

The key question for households then is just how much do you pay for what is now essentially a commodity in a bachelors degree (except of course at the top 100 universities around the world)? The answer is simple; as little as possible. As with any investment the more you pay for an asset, the less the return would be in subsequent time periods. Higher education was thought to be an exception. In a world of limited white-collar job creation, that is no longer the case. It is now a commodity, which must have a payout after the investment. Think twice before taking a second mortgage and disposing your assets to provide an expensive overseas education at unheard colleges.

Those who fail to recognise the new realities are doomed to find an over supply of graduates queuing up for jobs that someone with 10 years of schooling could do. Such a world would be as popular as opening for Lady Gaga in a three-piece pinstripe suit and singing Sinatra standards.

(Kajanga is an Investment Specialist based in Sydney, Australia. You can write to him at kajangak@gmail.com). |

The dichotomy is that high corporate profitability hasn’t alleviated the global unemployment problem.

Most policy measures around the world have tended to subsidize the demand for capital rather than the demand for labour. Investment tax credits (whichever name it goes by) makes the demand for capital cheaper – relative to the demand for labour – and leads to a substitution of labour for capital. The problem in the U.S. is not the lack of capital spending, since the second quarter such spending was running at annual growth rate of 25%; rather, the trouble stems from the lack of demand for labour and job creation.

The dichotomy is that high corporate profitability hasn’t alleviated the global unemployment problem.

Most policy measures around the world have tended to subsidize the demand for capital rather than the demand for labour. Investment tax credits (whichever name it goes by) makes the demand for capital cheaper – relative to the demand for labour – and leads to a substitution of labour for capital. The problem in the U.S. is not the lack of capital spending, since the second quarter such spending was running at annual growth rate of 25%; rather, the trouble stems from the lack of demand for labour and job creation.  The future of job creation is crucial to households who have to make significant financial decisions with regards to higher education. As highlighted in the previous column, rising tuition costs and declining white collar job availability together with a lack of real growth in wages have made a paid university degree (at second and third tier levels) less attractive today than at anytime in the past 30 years. This fact is compounded by two phenomena in the rising number of “graduates” in China and the demographic profile of India over the next two decades.

The future of job creation is crucial to households who have to make significant financial decisions with regards to higher education. As highlighted in the previous column, rising tuition costs and declining white collar job availability together with a lack of real growth in wages have made a paid university degree (at second and third tier levels) less attractive today than at anytime in the past 30 years. This fact is compounded by two phenomena in the rising number of “graduates” in China and the demographic profile of India over the next two decades.