With the tea crisis some months back, public opinion was created insinuating that the import of low quality tea to Sri Lanka is directly affecting the tea prices of Sri Lanka. Although at many a forum attempts were made to dispel this misconception, it started coming up again and again. The issue was taken up in the Parliamentary Consultative Committee (PCC) meeting several times culminating with a recent meeting at the PCC to discuss this issue fully.

In October 1980, the Cabinet of Ministers had decided that import of tea is allowed to Sri Lanka subject to (a) not allowing such imported low grade teas to be sold locally and (b) having taken adequate precautions to charge the applicable duty for the proportion of Ceylon tea blended with the imported tea at the point of export. In October 1980, the Cabinet of Ministers had decided that import of tea is allowed to Sri Lanka subject to (a) not allowing such imported low grade teas to be sold locally and (b) having taken adequate precautions to charge the applicable duty for the proportion of Ceylon tea blended with the imported tea at the point of export.

The basic objectives of this scheme for allowing imports of tea for blending purposes were:-

(i) To develop Sri Lanka as a tea hub amongst the tea producing countries of the region,

(ii) Allow import of cheap teas to be blended with Ceylon teas to regain the progressively losing value added benefit on the export of packets and tea bags,

(iii) To face the market competition in the world offering the consumers blends of teas with cheaper filler type teas obtained from international sources,

(iv) To allow import of CTC and green teas for blending and re-export.

It should be noted here that at this particular time only about 10% of our teas were exported as value added and we were widely known as a bulk tea exporter. The result was that the international tea blenders were making big profits from our teas that got blended in their hands with other origin teas. The argument therefore was to get that benefit for our local blenders/packers. This was a prudent and timely decision.

On the other hand local producers were not producing the filler type teas required for blending which is an essential ingredient for the growing tea bag industry. The small quantities produced were not at all adequate for blending purposes.

CTC tea needed for quick brewing which is an essential requirement for the tea bag industry was not at all being produced in Sri Lanka then. Therefore import of certain grades and categories of CTC teas was very necessary for the Sri Lankan tea bag industry to enter into this competitive market. Consequently the decision of the cabinet of Ministers was implemented from April 1981 giving it a legal status by a gazette notification.

Two developments that have taken place subsequently in the tea sector have to be taken into account in fairness to the concerns expressed by tea producers on import of tea for re-export. Firstly between 1982 and now 14 factories producing green tea and a few more factories producing organic tea have come up. Secondly between 1983 and now 35 factories engaged in the production of CTC teas exclusively or with dual lines have started production. Looking at the situation superficially therefore one might be carried away by the concerns expressed by the producers alleging that it is unfair to allow imports of teas which are being produced in Sri Lanka.

It has also to be pointed out that the scheme for importation of tea for blending and re-export thereafter underwent certain vital changes between 1994 and now, imposing restrictions on the operation of the scheme administratively based on Cabinet decisions taken from time to time. These are given below:

- 1994: Ban on any orthodox tea imports under the scheme

- 1994: Release of all imported teas only on a Bank guarantee to the total value of the consignment – the guarantee to be released only on the re-export of the imported teas.

- 2000: Ban on the import of poor quality teas, off grades, filler type teas and teas that do not come under the specialty category

- 2000: All imports to be accompanied with Maximum Residue Limit (MRL) certificates

- 2003: Imposition of a 25% duty on any import of orthodox teas for blending based on the report of the

Regulatory Review Task Force and under the Revenue Protection Act

- 2007: All imported teas to be within the SLTB Minimum Quality Standard and to be accompanied with a MRL Certificate issued by an accredited Pesticide Analytical Laboratory

- 2007: Ban on any teas to be imported from Vietnam even under the 25% duty scheme – 2007

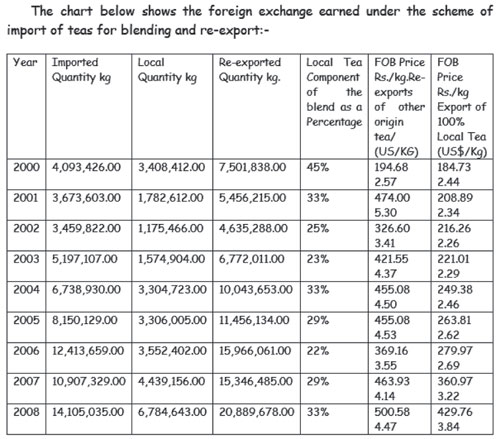

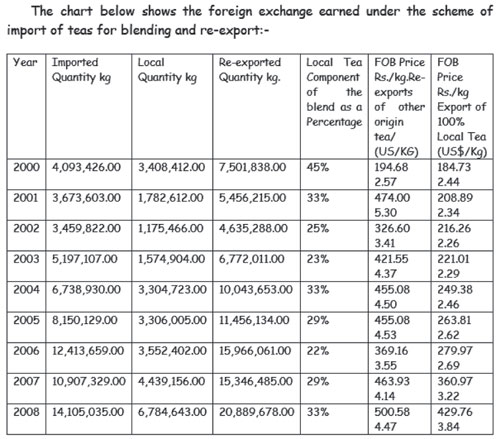

An analysis of these details show that the value addition in blending has resulted in bringing higher foreign exchange revenue as seen in column 6 compared to column 7. On the other hand the percentage of tea appearing in column 3 would otherwise have fetched a lower price as appearing in column 7 as bulk tea.

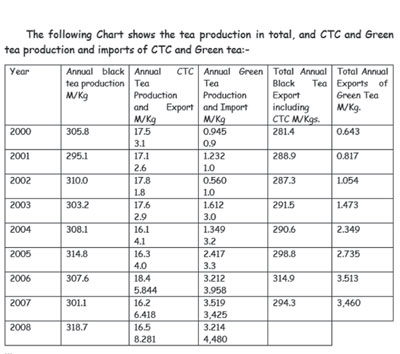

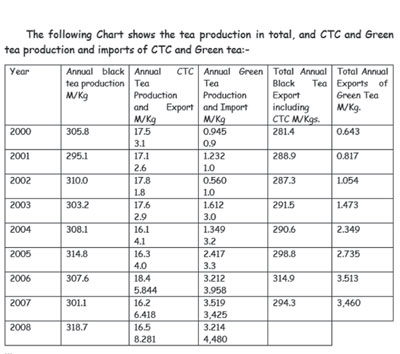

Salient features of this chart would show that not more than 5% of our black tea falls into the category of CTC and 95% is falling into the category of orthodox tea. It also shows that (column 7) more demand has been growing for green tea from other rigins from 2002 onwards implying that local production of green tea could not match the demand for multi origin green tea. Even in the case of CTC the demand for local CTC depends on the import of CTC for blending purposes.

Blenders would show that due to our production methodology and processes adopted, certain characteristics prevent blenders from adding higher percentages of local green tea and local CTC in their blends. Issues arising in the infusion especially with the off grades has driven the blenders to rely more on the import of other origins for blending. Especially in the production of tea bags it has been experienced that local CTC is slower in infusion compared to other origin CTC naturally shifting their preferences from local to other origin teas.

On the other hand one has to reckon the international marketing patterns, the consumer preferences and the purchasing powers of the consumers in the global situation. For example a particular supermarket chain would allow a Sri Lankan brand to have shelf space for an assortment of teas i.e. Uva, Dimbula, Ruhuna, Uda Pussellawa, Darjeeling, China Green tea, Kenyan CTC or decaffeinated tea. The importer would therefore wish that the exporter gives him the whole range in one consignment. So one is dictated by the buyer and has to oblige if the order is to be obtained.

If an exporter declines to satisfy the importer as above it would result in losing the order for a competitor as our competitors like India, Kenya, or for that matter Indonesia are waiting to grab such opportunities.

It has to be pointed out that the private sector entrepreneurs have invested so much money on tea bag machines of various types demanded by various markets, for instance, single chamber, double chamber, with or without string and tag, envelope sachets, pyramid type, tangle type, pot bags and the like. If the manufacturers are starved of the imports for their production they will suffer from running at under capacity. Business prudence would show them that it is profitable for them to shift their operations elsewhere!

Out of about 142 countries where Ceylon tea is exported, at least 100 are importing multi origin teas from Sri Lanka. This started from 1981. Sri Lanka is leading among the exporters of pre packed tea. If we are to retain our place in the market with the expertise gained over the years in supplying the world with the diversified product range, it is imperative that we continue with this trend.

On the other hand in case the import for re-export scheme is to be stopped there can be a serious unemployment problem arising leading to social problems. These entrepreneurs engaged in this business can shift their operations to places like Jebel Ali where they can continue with their work without any hindrance. At least 10% of our tea is bought by one buyer for a blending operation! This is a substantial slice of our exports and if we loose this operation by his deciding to shift the operation elsewhere it would have disastrous results.

Let us consider the options for us. An import duty on teas for re-export can be an option. But the immediate result would be that the competitive advantage that we enjoy in the market would be lost. No other country which competes with us charges duties on this category of imports for blending and re-export. Our cost of production is the highest in the region and therefore adding another cost would mean that we will kill the goose that lays the golden egg!

There is the possibility of specifying a minimum percentage of local tea going into the blend. But the blend is to be determined by the taste preferred by the consumer. The producer is obliged to give the consumer what he wants and not the other way about. A certain amount of control can of course be perhaps maintained by specifying a percentage of value addition in the blend exported.

As at present the SLTB monitors the Bank Guarantee system under which tea is allowed to be imported for re-export. The total quantity of imported tea has to be exported for the guarantee to be released. Minimum quality standards have got to be proven and MRL certificates have to be submitted with the samples for approval to be granted.

Once the consignment arrives samples will be drawn and matched with the samples in deposit before clearance is given for landing. The Customs Department has devised a separate HS code for imported teas for better monitoring purposes. These are some of the important precautions taken against possible misuse of the system.

What is required is therefore a tighter monitoring system to eliminate abuses and malpractices rather than to stop imports for blending purposes altogether as that would amount to throwing the baby with the bath!

|

In October 1980, the Cabinet of Ministers had decided that import of tea is allowed to Sri Lanka subject to (a) not allowing such imported low grade teas to be sold locally and (b) having taken adequate precautions to charge the applicable duty for the proportion of Ceylon tea blended with the imported tea at the point of export.

In October 1980, the Cabinet of Ministers had decided that import of tea is allowed to Sri Lanka subject to (a) not allowing such imported low grade teas to be sold locally and (b) having taken adequate precautions to charge the applicable duty for the proportion of Ceylon tea blended with the imported tea at the point of export.