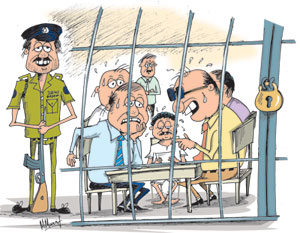

In a possible first not only in Sri Lanka but the rest of the world, a local court has sanctioned the conduct of a board of directors meeting in prison because most of the directors are in remand and depositors of the failed company want to withdraw their money fast.

The order was given by Colombo Chief Magistrate Nishantha Hapuarachchi to directors of the failed Finance and Guarantee (F&G) Group to hold the meeting at Welikada prison before Monday, August 24 in order to pass a resolution approving the setting up of a trust to facilitate repayment of some 5,600 depositors. Depositors have invested their money in F&G Property Developers (Pvt) Ltd and F&G Real Estate Co. Ltd at interest rates ranging from 22% to 31%, and 13% to 30%, respectively. The order was given by Colombo Chief Magistrate Nishantha Hapuarachchi to directors of the failed Finance and Guarantee (F&G) Group to hold the meeting at Welikada prison before Monday, August 24 in order to pass a resolution approving the setting up of a trust to facilitate repayment of some 5,600 depositors. Depositors have invested their money in F&G Property Developers (Pvt) Ltd and F&G Real Estate Co. Ltd at interest rates ranging from 22% to 31%, and 13% to 30%, respectively.

The court directive came following submissions made by Deputy Solicitor General (DSG) Yasantha Kodagoda on behalf of the Attorney General when the F&G financial fraud case was taken up last week. Mr Kodagoda told the court that he will not object against the granting of bail for all suspects if they unanimously agree and pass a resolution at the proposed board meeting at Welikada prison to set up this trust to sell all the assets and property of the F&G Group to refund the money of depositors. Mala Sabaratnam, one of the directors of the company, was directed to make arrangements for the board meeting. Mr Kodagoda said the shareholders meeting could be arranged later to ratify the resolution and noted that the board of trustees should comprise representatives of the Central Bank, F&G Group and the Depositors Association.

The DSG submitted that F&G Property Developers had paid interest to the depositors up to December 2008. Thereafter from January 2009 the depositors were not reimbursed with neither their deposits nor interest on same. He submitted that the company concerned was a subsidiary of the Ceylinco Group and by the end of March 31, 2009 the total value of 5,361 deposits of 2454 depositors was Rs. 4.2 billion.

According to deposit certificates issued by the company, this money has been invested in at least 14 real estate development projects including Country Housing Project, Majestic Apartments, Continental Residencies and Regency Apartments. Separately CID investigations revealed that the company has taken money from investors even after the completion of these projects.

The company has accepted the deposits by based on depositing such monies in the stated ventures “This is blatant cheating and criminal breach of trust,” he told court. He submitted that the company had utilized those monies in 10 other ventures like Fingara International Cricket Stadium, Blue Diamonds Ceylinco Coloured Stones Co, etc. He also submitted that the directors had utilized these deposits for their personal use.

The company spent a massive Rs.697 million for various other activities which had no connection whatsoever with their business of property development, Mr Kodagoda said, filing a report in court.

Ceylinco Chairman Lalith Kotelawala and three directors -- Mervyn Jayasinghe, K.A.S Jayatissa and Mohan Perera are in remand custody in connection with the case. The court also directed to freeze bank accounts of the company and its directors with immedate effect.

Meanwhile two directors of the F&G Real Estate, Chalaka Perera and Ranga Nanayakkara along with Mervyn Jayasinghe and K.A.S Jayatissa were remanded till Wednesday, August 18 by Colombo Fort Magistrate and Additional District Judge Gihan Pilapitiya last week, in connection with cheating of 3,087 deposits in a sum of Rs.3.9 billion. This money was obtained by the company from depositors promising to invest in 19 projects.

|

The order was given by Colombo Chief Magistrate Nishantha Hapuarachchi to directors of the failed Finance and Guarantee (F&G) Group to hold the meeting at Welikada prison before Monday, August 24 in order to pass a resolution approving the setting up of a trust to facilitate repayment of some 5,600 depositors. Depositors have invested their money in F&G Property Developers (Pvt) Ltd and F&G Real Estate Co. Ltd at interest rates ranging from 22% to 31%, and 13% to 30%, respectively.

The order was given by Colombo Chief Magistrate Nishantha Hapuarachchi to directors of the failed Finance and Guarantee (F&G) Group to hold the meeting at Welikada prison before Monday, August 24 in order to pass a resolution approving the setting up of a trust to facilitate repayment of some 5,600 depositors. Depositors have invested their money in F&G Property Developers (Pvt) Ltd and F&G Real Estate Co. Ltd at interest rates ranging from 22% to 31%, and 13% to 30%, respectively.