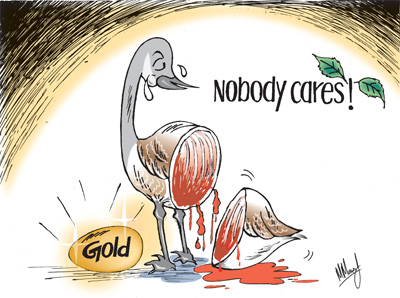

High export prices mask problems in the plantations

Tea prices were buoyant and contributed to most of the increase in agricultural export income. The net sales average of Rs. 337 million in 2007 was 23 percent higher than in 2006. On the supply side, a lower volume of exports from Kenya due to a decline in tea production caused mainly by political upheavals was an important contributory factor in increasing international tea prices. The demand for tea from oil producing Middle Eastern countries, Russia and East European countries were other significant factors in the increase of tea prices. These favourable developments mask serious problems in the plantations. These include the unsatisfactory trend in production and productivity, problems of labour shortages and labour unrest, lack of long term development programmes and inadequate research and extension to ensure continuous increases in productivity to decrease production costs and increase profit margins. There are of course serious social problems on the plantations, where poverty is highest, alcoholism is endemic and social and human development levels are unacceptably low. This favourable development in high export earnings mask the fact that tea production that reached a record level of 317 million kilogrammes in 2005 declined thereafter to 311 million kilogrammes in 2006 and by a further 2.9 percent to 305 million kilogrammes last year. Impliedly, had we achieved the levels of production of previous years we may have been able to earn more from exports. The export decline was somewhat less than the production decline owing to carry over stocks. Tea exports declined from 327 million kilogrammes in 2006 to 310 million kilogrammes in 2007. This declining trend in production has occurred despite nearly two-thirds of tea production being on small holdings. By all accounts tea production on small holdings have been continuously increasing and contributing to the total output of tea. The labour problems that affected estates in 2007 are one of the reasons for this fall in production. There are a number of inherent problems on the plantations. Tea yields on estates are much lower than the yields in other countries. Even leaving an allowance for agronomic factor differences of soil fertility and photo sensitivity, it is generally agreed that plantation tea yields are low compared to potential yields. The reasons for these are the low rate of replanting with the higher yielding vegetative propagated varieties(VP), senility of tea bushes and low density of tea bushes owing to the difficulties of finding labour for infilling. The required investments in tea replanting in particular must be made at the time when the industry can afford it. Yet, there is a problem as the replanting of senile tea areas with VP teas involves a loss of income. When prices are high there is a disincentive to undertake these due to the higher losses in income; and on the other hand when prices are low the industry lacks the funds for such investment. It is here that government policy can play a role. Although replanting attracts a subsidy from the government, yet this subsidy is considered rather inadequate to compensate tea growers for the losses in tea output during the gestation period. A redesigning of the subsidy for replanting tea is vital for the long run viability of tea estates that are only about one half as productive as small holdings, and of Kenyan tea. Overall macroeconomic conditions are harmful to a development policy for tea development. For many decades the country has had a policy of imposing a tax known as a cess on tea exports for the sole purpose of improving the tea industry. Funds from this tea cess were channelled to the Tea Board and the Tea Research Institute. In fact in recent years quite a considerable amount of money has been gathered by the government form the tea cess. For instance, last year on the basis of a cess of Rs 4 on each kilogramme of tea exported, the government collected over Rs 1200 million. Yet, only a part of these funds have been given to the institutions dealing with the industry. This is a good illustration of how stringent fiscal conditions distort development. However much the industry would request these funds for its development, the government is not in a position to release the required funds. In other words the tea cess is not serving the tea industry but financing the general expenditures of the government. When this is linked to the issue of the wasteful expenditure of the government discussed last week, the devastating consequences of wasteful government expenditure becomes apparent. It has been said of the tea industry that governments of the past killed the goose that laid the golden eggs. This is a reference to the high taxation of the industry, threat of nationalisation of the estates from the 1950s, the take over of the estates in the 1970s and mismanagement of the lands taken over by state institutions. These several policies had the end result of reducing tea production . In 1963 the country produced 233 million kilogrammes that dwindled to 209 million kilogrammes by 1989. Since then there has been an upward trend both due to better management of estates by private companies and the development of tea smallholdings. Yet, the production of 307 million kilogrammes last year was only 32 percent higher than the tea production of 1989. This, despite small holdings, now contributing 65 percent of total tea production. Although tea does not play as important a role in the economy as in the past, it has a significant role to play in earning foreign exchange. Its contribution to foreign exchange earnings is only second to that of garments. In fact if the net foreign exchange earnings are taken into account, its earnings are comparable to that of garments. The current good prices for tea should not lead to complacency in the development of the tea industry. In fact it is an opportunity to invest in the industry and undertake reforms that would make the industry viable and sustainable not only in economic terms but socially as well. Despite the high prices for tea and record earnings from tea exports, the long-run viability of the plantations is in question. The government must turn its attention to the fundamental problems facing the industry. |

|

||||||

|| Front

Page | News | Editorial | Columns | Sports | Plus | Financial

Times | International | Mirror | TV

Times | Funday

Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and a link to the source page.

|

© Copyright

2008 | Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |

Tea and Rubber prices peaked to record levels last year. Consequently export earnings from these two commodities increased significantly and gave immense support to the balance of payments. In 2007 agricultural export earnings were a record US Dollars 1507 million owing to the increased export earnings from these two crops. This healthy growth of export earnings of 16.6 percent from agricultural exports was mainly due to improved prices for both tea and rubber. Tea, the main agricultural export that accounted for over two thirds of agricultural exports, exceeded the US 1 billion dollar mark. Tea exports at US $ 1020 million were 16 percent higher than it was in 2006.

Tea and Rubber prices peaked to record levels last year. Consequently export earnings from these two commodities increased significantly and gave immense support to the balance of payments. In 2007 agricultural export earnings were a record US Dollars 1507 million owing to the increased export earnings from these two crops. This healthy growth of export earnings of 16.6 percent from agricultural exports was mainly due to improved prices for both tea and rubber. Tea, the main agricultural export that accounted for over two thirds of agricultural exports, exceeded the US 1 billion dollar mark. Tea exports at US $ 1020 million were 16 percent higher than it was in 2006.