Are you wasting your savings?Most of us are content with directing our salaries and income to our savings accounts and letting it stagnate there. What we don’t realise is that in the process we could become poorer! This is particularly so, in the current high inflationary environment.

What is inflation? Assume you saved Rs 100,000 in your savings account an year ago. Also assume that the cost of a certain motorcycle an year ago was Rs 100,000. The interest rate of the savings account was let’s say 6%. Therefore what you have in your savings account today is Rs 106,000. However if the cost of the motorcycle has increased by 15%, the cost of the motorcycle today is Rs 115,000. Therefore although you could buy the motorcycle last year with your savings, you can’t buy it today. Therefore you have become poorer! Now your objective should be clear. Make sure that the interest (or return) you get from your savings exceeds the rate of inflation. In the above example the return you get from your savings should be more than 15%, which is the rate of inflation. The problem we are faced with now is, where should we direct our savings to earn a return that exceeds the rate of inflation? Investment options If you channel your savings to the debt market you will be simply lending your savings to a borrower. This could be in the form of depositing in a savings account or a fixed deposit, which are effectively forms of lending to a bank. Or else you could invest in treasury bills or repurchase agreements (repos) through a primary dealer, which are methods of lending to the government. Before we decide as to how we should allocate our savings to these different investment options, we should understand the features of each option. Capital Market Through prudent decision-making one can achieve higher returns in the long-term by investing in real estate and the stock market. Debt Market In deciding the allocation of your savings to these different investing options, a careful consideration of your ability to take risk should be carried out, and the rate of return you could reasonably expect will depend on that. Optimal allocation

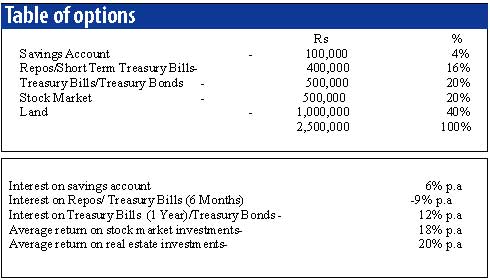

of your savings Most importantly the savings allocation decision will depend on the individual’s risk preference, for some of us are either risk takers or risk averse by nature. Therefore the best way to get an idea as to how savings should be utilised is by taking an example. Mr. Perera, who is 45 years of age, has two children. His current income is sufficient to meet his monthly expenses. However he would like to go on holiday (or any other form of entertainment) with his family at the end of the year which cannot be met with his monthly income. He has savings of Rs 2.5 million. He expects to pay Rs 800,000 in five years and Rs 1.5 million in 10 years for the higher education of his two children. At the age of 60 he plans to retire and donate his children a substantial amount of money for them to come up in life. In order to decide on the best way to allocate savings in this scenario, let’s first assume (bearing in mind the rate of inflation is assumed to be 15% p.a) what the rate of return will be from different investment options: Let’s consider Mr Perera’s situation. He will be employed for 15 more years and during this period his income from employment will be sufficient for his day to day expenses. He is not planning to incur any major expenses in the near future. Therefore in his case he has substantial capacity to bear risk in allocating his savings. Consider the above allocation of his savings (see table). By allocating Rs 500,000 in treasury bills/treasury bonds it is possible to meet the education-spending requirement due in five years by redeeming the treasury bills/treasury bonds at the end of the fifth year. So far we have allocated Rs 1 million (40% of total savings) to low risk investment options while meeting relatively short-term cash needs. Since Mr. Perera can bear a substantial amount of risk due to his present situation, he can afford to channel the balance Rs 1.5 million to more risky but more profitable investment options. In this case Rs 0.5 million and Rs 1 million are invested in the share market and on a piece of land, respectively. By the 10th year the value of share investments will be Rs 2.6 million (with an annual increase of 18%) and the value of the land will be Rs 6.2 million (with an annual increase of 20%). Therefore Mr. Perera will be able to meet the education expenses of Rs 1.5 million easily by either selling part of his shares or the land. Assuming the remaining Rs 7.3 million is invested at 12% p.a in treasury bills/treasury bonds from that point onwards until he retires, by the time Mr Perera retires his asset position will be approximately Rs 13 million. At this point Mr Perera can distribute a further Rs 5 million among his children and invest the balance Rs 8 million in fixed deposits and use the interest for his monthly expenses thereafter. If he invests in fixed deposits at 12% p.a, his interest income for a month will be Rs 80,000 for the rest of his life! Conclusion An important aspect for one to remember is to assess the allocation of savings periodically. For instance in this case Mr Perera, after allocating the savings in the above manner should assess his position after one year (or in case of an unexpected event such as an unexpected, substantial income or expense) and if required should reallocate his savings. Therefore this process is a continuous process that ensures your savings are used in the most suitable manner. |

|

||

| || Front

Page | News

| Editorial

| Columns

| Sports

| Plus

| Financial

Times | International

| Mirror

| TV

Times | Funday Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and the source. |

© Copyright

2007 | Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |