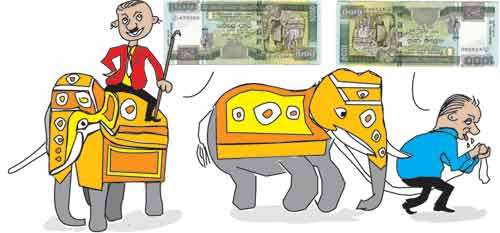

Money crunch crushing small and medium enterprises

The current ground situation is one where small industries are crumbing. The tight money policy affects them immediately. Denied credit by banks small industries have nowhere to turn. Often the failure of one impacts on other small industries and a cycle of small business failures are witnessed. Small and medium industry failures on a large scale are very much on the cards unless some adaptations in the current monetary policy stance are adopted. In the face of mounting government expenditure particularly on military hardware, there is no doubt that the Central Bank would continue or even strengthen its tight monetary policy stance to counter inflationary pressures. A Central Bank spokesman has already said that inflationary pressures have been contained somewhat but will have to be further controlled. He also made the important point that monetary policy alone can’t control the inflationary pressures and that fiscal policies too should attempt to be less inflationary. The latter advice is hardly heard and the government’s spending spree continues unabated. The burden of controlling inflation has fallen on the monetary authorities. Their task is onerous; they can only succeed to a limited extent if the fiscal imbalances continue to grow. Besides, the control of inflation through tight monetary policy measures would inevitably harm investment and growth. Tight money policies are a double edged instrument. In the process of controlling inflation it denies access to credit so vital to investment. In the case of larger enterprises they may have their own reserves, they may be able to access capital through direct means such as borrowing directly from sources outside the conventional financial intermediaries through the process that economists call ‘financial disintermediation’. Bigger enterprises may also be able to pass on the higher costs of production to consumers owing to higher costs of finance to customers. This is especially so as price rises become accepted when the general price level is continuously increasing. These options are hardly available to small producers who must depend on bank borrowing. The withdrawal of credit facilities to small entrepreneurs can well be their death blow. Illustrative of what is happening to small enterprises is the case of Asoka’s small business. It is around ten years old. It began as a family enterprise. They had only a few employees to begin with. They have their own style of management that may not quite accord with the principles taught at the Harvard Business School. Their commitment to hard work, willingness to learn from mistakes and receptivity to business opportunities were among the characteristics that propelled the business to success. The measure of success was such that they got orders that they could not cope with. They even had small orders from abroad. They gradually invested in machinery by borrowing from several banks and personal sources. These funds and the expanding market opportunities enabled them to enlarge their business. Business was looking good even at the beginning of this year. They were repaying the loans they had taken and if business continued as usual they had projected that they would be able to repay all their loans within the next eighteen months. Then the unexpected happened. The three banks they had borrowed from either as loans or overdrafts or both called in the loans and suspended the overdraft facilities. At the same time the post-dated cheques they had received (as is a common practice in Sri Lankan business) bounced. When they contacted those who had issued the cheques they heard the story they knew so well. Their overdrafts had also been stopped and cheques were being returned. The wheels of a successful and expanding medium scale enterprise are grinding to a halt. In this scenario of a decreasing supply of credit and increasing costs of credit to private enterprise, it is unrealistic to think that the growth momentum of the economy remains intact and that GDP growth is likely to surpass 7 per cent. The Central Bank has also a rather unrealistic expectation of expecting average inflation to be around 8 per cent for the year. In its Road Map of monetary policy the Central Bank had set a full-year average inflation target of 6.5 per cent. Another unrealisable target. The government and the Central Bank might say that the monetary stance taken is not meant to crush the economy by taking an excessively severe monetary stance. That may very well be the intention but the outcome of the tight monetary policy stance may be quite different even though the policies may succeed in a visible downturn in inflation. There is a strong likelihood that interest rates would be tightened further in coming months with a further crippling of small and medium scale enterprises. If the perilous state of small enterprises is to be avoided there should be stricter vigilance on the widening current account deficit. While this would enable the monetary authorities to cope with the inflationary situation in a less stringent manner, there should be specific measures to ensure that the tight monetary policies are selectively applied to protect vulnerable small industries. The long-run health of the economy must not be sacrificed by continued fiscal overspending. A sustainable current account deficit is the need of the hour. |

|| Front

Page | News | Editorial | Columns | Sports | Plus | Financial

Times | International | Mirror | TV

Times | Funday

Times || |

| |

Copyright

2007 Wijeya

Newspapers Ltd.Colombo. Sri Lanka. |

Small industries are facing a severe crisis. Small and medium enterprises are the most vulnerable to tight money policies. They are the first to fall when the supply of credit shrinks and the costs of borrowing rise. There is a misconception that macro economic fundamentals, inflationary trends and monetary policy only affect big enterprises and that small industries are somehow outside the pale of macro economic developments and financial developments. Often policy makers think that these small units are not that much affected by macroeconomic imbalances that lead particularly to tight money policies. Nothing is further from the truth than this misconception.

Small industries are facing a severe crisis. Small and medium enterprises are the most vulnerable to tight money policies. They are the first to fall when the supply of credit shrinks and the costs of borrowing rise. There is a misconception that macro economic fundamentals, inflationary trends and monetary policy only affect big enterprises and that small industries are somehow outside the pale of macro economic developments and financial developments. Often policy makers think that these small units are not that much affected by macroeconomic imbalances that lead particularly to tight money policies. Nothing is further from the truth than this misconception.